Loading

Get This Claim Is Filed For Fiscal Year 20 - 20

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Claim Is Filed For Fiscal Year 20 - 20 online

This guide provides a step-by-step approach to assist users in accurately completing the This Claim Is Filed For Fiscal Year 20 - 20 form online. Whether you are familiar with digital forms or new to the process, this guide aims to simplify your experience and ensure that your claim is filed correctly.

Follow the steps to fill out your claim accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital document editor.

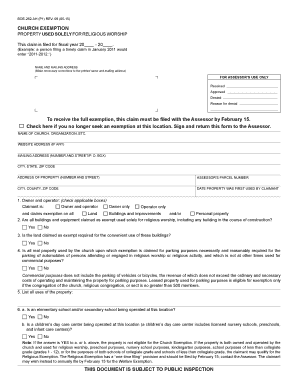

- In the section labeled 'This claim is filed for fiscal year', fill in the fiscal years appropriately (example: 20XX - 20XX). Ensure accuracy to avoid processing delays.

- Enter your name and mailing address in the designated fields. Make sure to correct any pre-printed errors that may be present.

- Indicate your church or organization’s name and website address, if applicable. Complete the mailing address and property address fields.

- Provide the Assessor’s Parcel Number and the city, county, and ZIP code of the property.

- Specify the date the property was first used by your organization.

- In the 'Owner and operator' section, check the applicable boxes to indicate if the claimant is the owner, operator, or both for exempted properties.

- Respond to the questions about building usage, confirming that all claimed buildings and equipment are for religious worship.

- Answer questions regarding parking purposes and confirm the necessity of any claimed land for convenient use.

- List all uses of the property clearly and completely, following all relevant questions regarding any schools or daycare centers.

- Disclose whether the property is owned or leased, and provide the owner's name and address if applicable.

- Indicate any rental agreements that may affect exemption eligibility, including details for any sub-leases.

- State any changes to property use or construction since January 1 of the previous year, and provide descriptions.

- Complete the contact information section, including name, title, daytime telephone, and email address.

- Verify all provided information, then sign and date the certification section to declare the accuracy of your claim.

- At the end, you can save changes, download the completed form, print it for submission, or share it electronically.

Start your claim today and complete the form online to secure your church exemption.

Generally, there's no penalty for filing after the April 18 deadline if a refund is due. Also, people still have time to get their full Child Tax Credit or claim a Recovery Rebate Credit if they didn't get the full amount of their third stimulus payment, but they need to file a 2021 tax return to receive them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.