Loading

Get Illinois Department Of Revenue 2008 Il 1040 X Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

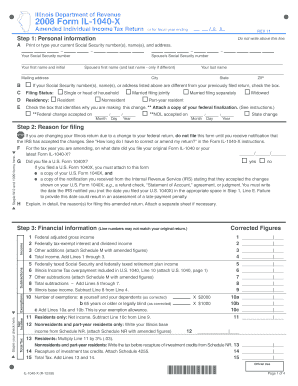

How to fill out the Illinois Department Of Revenue 2008 IL 1040 X Form online

Filling out the Illinois Department Of Revenue 2008 IL 1040 X Form online can streamline the process of amending your individual income tax return. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your personal information in Step 1. This includes your current Social Security number, name, and address. Ensure all details are accurately provided. If your information differs from a previously filed return, check the corresponding box.

- Indicate your filing status and residency by selecting the appropriate options. Specify the reason for making the changes to your return and attach any required documentation, such as federal finalization notices or additional forms.

- In Step 3, input the corrected financial information. Carefully enter your federal adjusted gross income, income subtractions, exemptions, and tax calculations. Each line requires specific figures, so ensure you have the correct amounts available.

- Continue with Step 4, where you will determine your refund or balance due. Follow the instructions for calculating overpayments or underpayments. Make sure to include any penalties or interests applicable.

- Finally, complete Step 5 by signing and dating the form. Include your daytime phone number, and if applicable, your spouse's and preparer's signatures and information.

- Review your completed form for accuracy. Once satisfied, you can save changes, download the document, print it, or share it as needed.

Complete your amendment documents online today for a smoother filing experience.

File Form IL-1040-X, Amended Individual Income Tax Return, for tax years ending on December 31, 2021, and December 31, 2020, on MyTax Illinois. Use MyTax Illinois to electronically file your Amended Individual Income Tax Return. It's fast, easy, and free.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.