Loading

Get Consumer Loan Application - Fnbmifflintown.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CONSUMER LOAN APPLICATION online

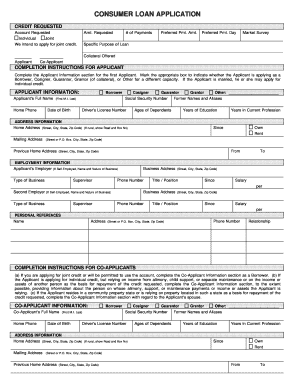

Filling out the consumer loan application is an essential step in securing financing. This guide will provide clear and user-friendly instructions to help you complete the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Use the 'Get Form' button to initiate the process and access the application form.

- Begin with the credit requested section. Indicate whether the account is individual or joint by selecting the appropriate box. Specify the amount requested and other preferences related to payment.

- In the applicant section, provide your full name, home phone number, date of birth, and driver’s license number. Ensure you check the appropriate box to indicate your role as borrower, cosigner, guarantor, or other.

- Fill in the address information. Include your current home address and mailing address if different. Also, provide your Social Security number, former names, and ages of dependents.

- In the employment information section, enter details about your current employer, including the business name, your title, the address, and your supervisor’s name. If you have a second employer, complete that section as well.

- List personal references by providing their names, addresses, phone numbers, and your relationship to them.

- If applicable, fill out the co-applicant information section similarly to how you completed the applicant information.

- Answer the yes/no questions regarding your financial history truthfully. Provide explanations on an attached sheet if necessary.

- Complete the previous credit references section, including creditor names, loan purpose, and account details.

- Fill out the schedules for other income, expenses, liabilities, and assets as applicable.

- Review the credit life and disability insurance preferences, indicating your desires for these optional insurances.

- Finally, sign and date the application to certify the information provided is accurate. Once completed, save any changes, and if necessary, download, print, or share the form.

Complete your consumer loan application online today and take the first step toward your financial goals.

The Basics of Consumer Loans. There are two primary types of debt: secured and unsecured. Your loan is secured when you put up security or collateral to guarantee it. The lender can sell the collateral if you fail to repay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.