Loading

Get 3314 Hsa Withdrawal Authorization (4/2015) - Georgiasown

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 3314 HSA Withdrawal Authorization (4/2015) - Georgiasown online

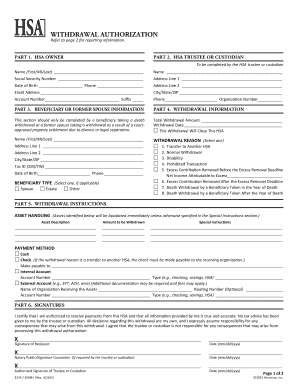

This guide offers clear and comprehensive instructions for completing the 3314 HSA Withdrawal Authorization form, ensuring that users can navigate the process smoothly. By following these steps, you can efficiently fill out the form online while understanding each section's requirements.

Follow the steps to successfully complete your withdrawal authorization.

- Press the ‘Get Form’ button to access the 3314 HSA Withdrawal Authorization form and open it in your preferred editing application.

- In Part 1, enter the name of the HSA owner. Ensure that you provide the first name, middle initial, and last name accurately.

- Proceed to Part 2 to fill in the HSA trustee or custodian information, including their name, social security number, address, date of birth, and contact information.

- If applicable, complete Part 3 with beneficiary or former spouse information, ensuring you provide accurate names and contact details.

- In Part 4, fill out the withdrawal information. Specify the total withdrawal amount, withdrawal date, and indicate if this withdrawal will close the HSA.

- Select the appropriate withdrawal reason from the provided options. Fill in the required details for the withdrawal reason selected.

- Continue to Part 5 where you provide withdrawal instructions, asset descriptions, the amount to be withdrawn, and any special instructions you may have.

- Indicate your preferred payment method in the same section, either cash, check, internal account, or external account. If applicable, include the relevant account and routing information.

- Finalize your submission in Part 6 by providing your signature and the date, confirming your authority and the accuracy of the provided information.

- After completing the form, you can save your changes, download a copy, print it, or share the completed form as required.

Complete your HSA withdrawal authorization online today and ensure your financial needs are met efficiently.

You can withdraw funds from your HSA anytime. But keep in mind that if you use HSA funds for any reason other than to pay for a qualified medical expense, those funds will be taxed as ordinary income, and the IRS will impose a 20% penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.