Loading

Get 51a158

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 51a158 online

Filling out the 51a158 form online can seem daunting, but with clear guidance, you can navigate the process with confidence. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the 51a158 form online.

- Press the ‘Get Form’ button to access the 51a158 online form and open it in your preferred editor.

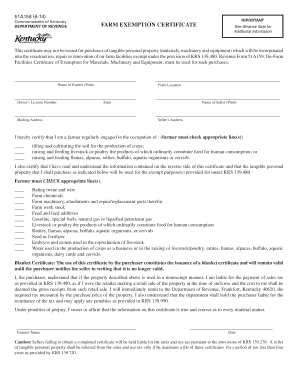

- Begin by identifying yourself as a farmer. Check the appropriate box that corresponds to your farming activities: tilling and cultivating soil, raising livestock or poultry for human consumption, or raising specific animals such as llamas or alpacas.

- Read the information provided on the reverse side of the form carefully. This will guide you on the exempt purposes outlined under KRS 139.480.

- Now, check the applicable line(s) for the tangible personal property you plan to purchase. This includes options like baling twine, farm machinery, livestock feed, and other items specified in the form.

- Indicate if you are using this certificate as a blanket certificate, which remains valid until you inform the seller in writing that it is no longer valid.

- Confirm your understanding that if the property is used in a nonexempt manner, you will be responsible for paying the sales tax as outlined in KRS 139.490.

- Complete the certification by signing your name, printing your name, providing your farm location, driver’s license number, and mailing address.

- Finally, save your changes and use the options available to download, print, or share the completed form as needed.

Complete your 51a158 form online today to ensure compliance and take advantage of available exemptions.

Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural assets, subject to a $25,000 calendar year cap and a $100,000 lifetime cap.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.