Loading

Get Form 99 Ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 99 EZ online

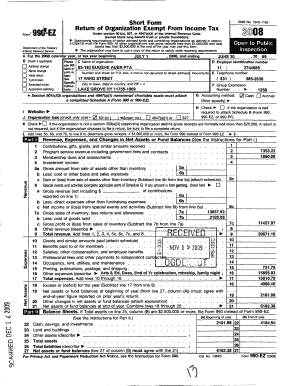

Filling out Form 99 EZ is essential for organizations seeking to exempt themselves from income tax. This guide provides a clear, step-by-step approach to completing the form online, ensuring you understand each section and field.

Follow the steps to successfully complete Form 99 EZ online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the calendar year for which the return is being submitted at section A, and indicate whether this is an initial return, an amended return, or a termination.

- Complete section C by accurately typing the name of your organization, ensuring it matches the official records.

- In section D, input the employer identification number (EIN) assigned to your organization.

- Provide the organization’s telephone number in section E, ensuring the area code is included.

- Indicate the organization's accounting method in section G by selecting either cash or accrual.

- In section J, select the type of organization by checking the appropriate box for 501(c), 527, or 4947(a)(1) organizations.

- Fill out the revenue, expenses, and changes in net assets or fund balances in Part I, carefully adding figures to ensure accuracy.

- Complete the Statement of Program Service Accomplishments in Part III, describing the organization's primary exempt purpose and the services provided.

- In Part IV, list all officers, directors, trustees, and key employees, ensuring that their names, titles, and compensation details are correct.

- Review all provided information thoroughly to ensure accuracy and consistency.

- Once all sections are filled out and verified, save changes to the form, then download, print, or share as needed.

Complete your Form 99 EZ online today to ensure timely and accurate reporting!

Don't get caught up in the unappealing, undecipherable form names. 990 filing is much less confusing than it looks. All you need to know is that form 990-N means your company makes less than a certain amount in revenue, and thus there's less for you to fill out versus the other versions of the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.