Loading

Get Mi Cis Uc 1017 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI CIS UC 1017 online

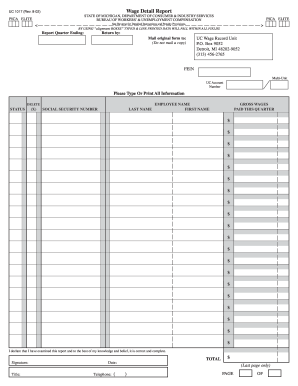

Filling out the MI CIS UC 1017 form accurately is essential for reporting wage details to the appropriate state department. This guide provides straightforward steps to help you complete the form online with confidence.

Follow the steps to complete the MI CIS UC 1017 form online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- At the top of the form, enter the employer name, address, UC account number (including the Multi Unit Number), Federal Employer Identification Number (FEIN), and the quarter ending date.

- For each employee, enter their Social Security number, last name, first name, and gross wages paid during the quarter.

- If there are any unlisted employees to whom wages were paid, enter their Social Security number and name to ensure compliance with reporting requirements.

- If you need to delete an employee's information, place an 'X' in the Delete column next to that employee. Remember that if wages are reported, the name cannot be deleted.

- For any employee not paid during the quarter, enter zero (0) in the gross wages field for them. This will maintain their inclusion in future reports.

- Ensure that the total gross wages reported on the last page equals the total shown on the Employer's Quarterly Tax Report (Form UC 1020) for accuracy.

- Review all entries for accuracy, and sign and date the form where indicated, providing your title and telephone number.

- Once the form is completed, you can save your changes, download, print, or share the form as needed.

Complete your MI CIS UC 1017 form online today for accurate wage reporting.

MI Form 4567 must be filed by employers who wish to appeal a determination made by the Michigan Unemployment Insurance Agency. This might include decisions about benefits or tax assessments. Knowing when and how to file this form is essential, and resources like MI CIS UC 1017 can greatly assist during this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.