Get Il Ui-1 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL UI-1 online

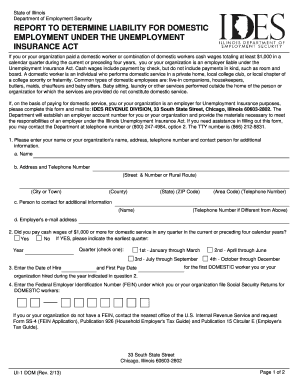

The IL UI-1 form is crucial for individuals or organizations that employ domestic workers and need to determine their liability under the Unemployment Insurance Act. This guide provides step-by-step instructions to help you complete the form accurately and effectively.

Follow the steps to fill out the IL UI-1 online.

- Click ‘Get Form’ button to obtain the IL UI-1 form and open it in an appropriate digital platform for editing.

- In the first section, enter your name or your organization's name, followed by the address and telephone number. Ensure that you include your county and zip code to provide complete contact information.

- Identify a person who can be contacted for additional information. Fill in their name and, if different, their telephone number.

- Provide the employer's email address for further correspondence or queries regarding your submission.

- Answer the question regarding whether cash wages of $1,000 or more have been paid for domestic service in the current or any preceding four calendar years. If yes, specify the earliest quarter and year.

- Enter the Date of Hire and First Pay Date for the first domestic worker hired during the year indicated in question 2.

- Fill in your Federal Employer Identification Number (FEIN) as required. If you do not have one, follow the instructions provided to request an FEIN from the IRS.

- Indicate whether you elect to file your State of Illinois Unemployment Insurance Contributions and Wage Report annually if applicable.

- Complete the certification statement by signing and dating the form. Ensure that the report is signed by the appropriate person as identified in the instructions.

- Once the form is completed, ensure to save any changes made. You may also print or share the form as needed.

Take the necessary steps today to complete your IL UI-1 form online and fulfill your obligations as an employer.

Related links form

UI on your paycheck typically stands for Unemployment Insurance, which is a deduction taken from your earnings. This deduction contributes to the state's unemployment fund, ensuring financial support for you if you face sudden job loss. Understanding this deduction helps you realize its role in safeguarding your financial future. If you want more clarity on benefits or how this relates to your overall earnings, exploring the IL UI-1 resources can be helpful.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.