Loading

Get Ca De 1np 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 1NP online

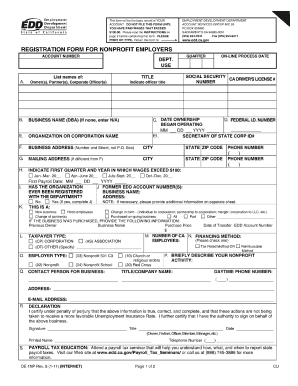

Filling out the CA DE 1NP form online can streamline your documentation process. This guide provides clear instructions to help users navigate each section of the form effectively.

Follow the steps to successfully complete the CA DE 1NP form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by filling in your personal information, including your name, address, and contact information. Ensure that all details are accurate to avoid any delays in processing.

- Next, indicate your employment status by selecting the corresponding option that best describes your current situation.

- Proceed to provide details about your income and employment history. This section may require specific information regarding your previous jobs and earnings.

- Complete the section pertaining to any benefits you may be receiving. This includes unemployment compensation or other financial assistance.

- Review all entered information for accuracy. Ensure there are no errors or omissions, as this can affect your submission.

- Once all sections are completed, save your changes, and look for options to download, print, or share the form with relevant parties.

Get started with your documentation by completing the CA DE 1NP form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The 33% rule for nonprofits refers to the guideline that an organization should ideally devote at least 33% of its resources to its charitable purposes. This rule helps ensure that a significant portion of funds are used effectively and not just for administrative costs. Understanding this rule is essential for maintaining compliance and trust with your donors. UsLegalForms provides valuable insights to help manage your nonprofit efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.