Loading

Get Ct Cccen 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CCCEN online

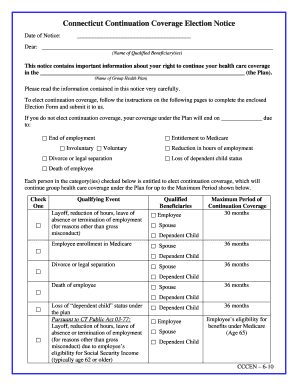

The Connecticut Continuation Coverage Election Notice (CT CCCEN) allows individuals to maintain their health care coverage after a qualifying event. This guide provides detailed instructions on how to complete the CT CCCEN form online, ensuring you can take the necessary steps to retain your coverage.

Follow the steps to complete the form accurately

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the date of the notice at the top of the form. This date is crucial as it marks the beginning of your election period.

- Enter the name of the qualified beneficiary or beneficiaries. This refers to the individuals entitled to continuation coverage under the plan.

- Provide the name of the group health plan. Ensure you input the exact title as listed in your original notification.

- Check the applicable box under the 'Qualifying Event' section. This indicates the reason for your request to elect continuation coverage.

- For each qualified beneficiary, check the appropriate box specifying who is entitled to coverage. This may include yourself, spouse, or dependent children, as applicable.

- Select your coverage option by checking the appropriate box, such as 'Employee', 'Employee + Spouse', etc., and fill in the monthly premium amount.

- Sign the election form, including your printed name below your signature, and indicate the date of signing.

- Provide your relationship to the listed individuals, your address, and telephone number.

- Review all filled information for accuracy before submitting, and send the completed Election Form to the provided address, ensuring it is post-marked no later than 60 days from the notice date.

- After submitting, keep a copy of the form for your records. You will need it for any future reference regarding your coverage.

Complete the CT CCCEN online to secure your health coverage today.

Related links form

If you made less than $5000 in Connecticut, whether you must file taxes depends on your specific circumstances. The CT CCCEN outlines different thresholds based on various factors including your filing status. While you may not be required to file, doing so might still offer benefits such as potential refunds. Always evaluate your situation carefully before making a decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.