Get Ct Caao M3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CAAO M3 online

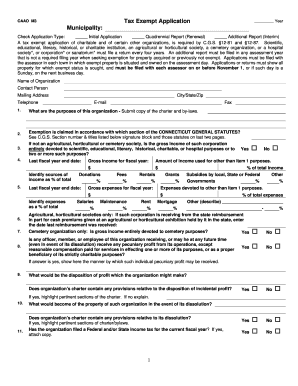

Filling out the CT CAAO M3 form is essential for organizations seeking property tax exemptions in Connecticut. This guide provides step-by-step instructions to help you navigate the online process effectively, ensuring all necessary information is accurately reported.

Follow the steps to complete the CT CAAO M3 application online

- Press the ‘Get Form’ button to retrieve the CT CAAO M3 form and open it in the online editor.

- Enter the year of the application in the designated field at the top of the form.

- In the 'Municipality' field, specify the town or city where the property is located.

- Select the type of application by checking the appropriate box for 'Initial Application', 'Quadrennial Report (Renewal)', or 'Additional Report (Interim)'.

- Fill in the name of your organization and the contact person responsible for the application.

- Provide the mailing address, including city, state, and zip code for correspondence.

- Include the contact telephone number, email, and fax number, if applicable.

- Detail the purposes of the organization by submitting a copy of the charter and by-laws.

- Indicate which section of the Connecticut General Statutes exempts your organization, referring to the list provided on the form.

- Provide financial details including last fiscal year end date, gross income for the fiscal year, and percentages allocated to different income sources.

- Document any expenses devoted to purposes other than those stated in item 1, ensuring to list each as a percentage of total expenses.

- Complete the section concerning whether any officer, member, or employee might receive a pecuniary profit from the organization's operations, answering with Yes or No as applicable.

- Record the intended disposition of any profit made by the organization and highlight relevant sections of the charter if applicable.

- Include information regarding the property at assessment day, such as book and market values, as well as the use of the property.

- Review every section and field for accuracy before submitting.

- Once complete, you can save changes, download, print, or share the form directly from the online platform.

Start filling out the CT CAAO M3 form online today to secure your organization's tax exemptions.

Related links form

The personal property tax credit in Connecticut is designed to reduce the tax burden for individuals owning qualifying personal property. This credit applies to specific categories of property and can lead to significant savings. Understanding the intricacies of the CT CAAO M3 can help potential claimants navigate the process more efficiently, and uslegalforms can assist in filing accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.