Loading

Get Retirement Planning Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retirement Planning Questionnaire online

Completing the Retirement Planning Questionnaire is a crucial step in planning your financial future. This guide will provide you with a structured approach to filling out the form online, ensuring that you include all necessary information for your retirement planning.

Follow the steps to complete the questionnaire accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

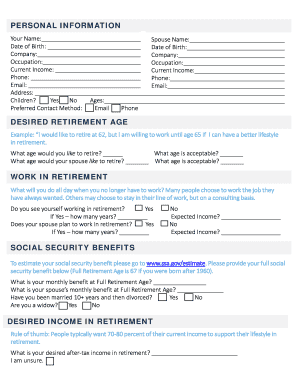

- Begin by filling in your personal information. Provide your name, date of birth, occupation, current income, contact details, and preferred communication method. If applicable, also enter your partner’s information.

- Specify your desired retirement age. Indicate the age you aim to retire, along with acceptable ages for both yourself and your partner.

- Indicate whether you plan to work in retirement. Answer whether you plan to work and the duration of that work, and do the same for your partner's work intentions.

- Provide details about your social security benefits, including your expected monthly benefit at Full Retirement Age and your partner's. Also, indicate your marital status regarding divorce and widowhood.

- Detail your desired income in retirement, suggesting what your after-tax income goal is, stating if you are unsure.

- List your assets. Enter the current balance, annual contribution for your retirement savings, including employer contributions, along with any other investments or savings accounts.

- Outline your debts. For each debt, provide the description, balance, monthly payment, and interest rate to give a clear picture of your financial obligations.

- Answer additional financial planning considerations such as if you have a will or trust, information regarding saving for dependents' education, life insurance status, and household budget creation.

- Lastly, include any other financial concerns or questions you might have. Ensure all fields are completed, and submit the questionnaire along with any necessary statements as instructed.

Start filling out your Retirement Planning Questionnaire online today to take control of your financial future.

You can work through these questions yourself or ask a financial advisor to help you project how your retirement might unfold. How Much Money Do I Need to Retire? When Should I Claim Social Security? How Much Will Healthcare Cost in Retirement? How Do I Spend From My Retirement Savings?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.