Loading

Get Ct 3 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 3 1 online

This guide provides a clear and supportive approach to filling out the Ct 3 1 form online. Designed for users of all experience levels, it offers step-by-step instructions to ensure a smooth experience.

Follow the steps to fill out the Ct 3 1 form efficiently.

- Press the 'Get Form' button to access the Ct 3 1 form and open it in your preferred online editor.

- Begin by entering the legal name of the corporation in the designated field. Ensure that the name matches official records.

- Input the Employer Identification Number (EIN) in the specified section. This number is essential for tax identification purposes.

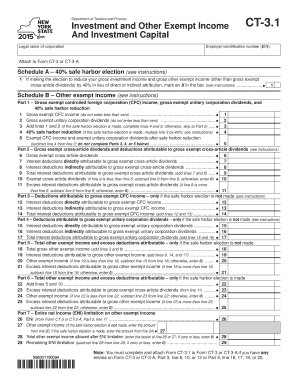

- Proceed to Schedule A and mark an X in the box if you are making the 40% safe harbor election. Refer to instructions for additional information.

- Fill out Schedule B, starting with gross exempt controlled foreign corporation (CFC) income and unitary corporation dividends, ensuring you do not enter negative values.

- If the safe harbor election is elected, calculate the 40% safe harbor reduction based on your figures in Schedule B.

- Complete all relevant sections in Schedule C, including investment income and deductions, particularly focusing on the safe harbor election criteria.

- Review the information you've entered to ensure accuracy and completeness, including any necessary schedules based on your corporation's specific circumstances.

- Once all fields are properly completed, save your changes, then choose to download, print, or share the completed Ct 3 1 form as needed.

Complete your Ct 3 1 form online today for a streamlined filing experience.

Mail returns to: NYS Corporation Tax, Processing Unit, PO Box 1909, Albany NY 12201-1909. If you use a delivery service other than the U.S. Postal Service, see Private delivery services below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.