Loading

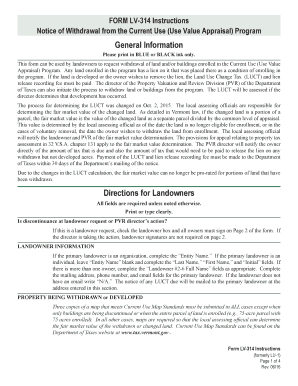

Get Form Lv-314 Instructions Notice Of Withdrawal From The ... - Tax Vermont

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FORM LV-314 Instructions Notice Of Withdrawal From The Current Use (Use Value Appraisal) Program online

The FORM LV-314 serves as a vital document for landowners seeking to withdraw properties from Vermont's Current Use Program. This guide offers a detailed, step-by-step approach to completing this form online, ensuring a clear understanding of the necessary fields and requirements.

Follow the steps to successfully complete your notice of withdrawal.

- Press the ‘Get Form’ button to obtain the FORM LV-314 and open it in your preferred online editor.

- Identify whether the withdrawal is requested by the landowner or initiated by the PVR director. Check the appropriate box on the form. If it is a landowner request, ensure all owners sign on Page 2.

- Fill out the Landowner Information section. If the primary landowner is an organization, input the 'Entity Name.' For an individual, leave it blank and complete the 'Last Name,' 'First Name,' and 'Initial' fields. Provide contact details and indicate 'N/A' if there is no email.

- In the Property Being Withdrawn or Developed section, submit three copies of a Current Use compliant map unless only buildings are being withdrawn or the entire parcel is involved. This helps assessors determine fair market value.

- Enter the SPAN of the parcel. If it is a part of a new parcel, provide the SPAN of what was previously enrolled.

- Specify the Municipality where the land is located. If spanning multiple cities or towns, you must file separate forms for each location.

- Input the Withdrawal Date. This must be a past or current date, not a future date. For transfers, use the recording date.

- For Farm Buildings Being Withdrawn, list the number of buildings being removed along with a brief description. If retaining some buildings, document them on a separate note. If not withdrawing any, write 'N/A' or '0.'

- Complete the Acres Withdrawn section by stating the relevant acres to two decimal places, providing a brief description of their status.

- In the Acres Developed section, detail the acres being developed similarly. If none, enter '0.' If multiple lots are involved, prepare a separate form for each lot.

- Fill in the Lien Recording Information section if applicable. This can be obtained by consulting municipal land records.

- If the withdrawal is the owner's request, ensure all necessary signatures are collected on page 2. Original signatures must be provided.

- Once completed, review the entire form for accuracy before saving your changes, downloading, printing, or sharing as needed.

To manage your land withdrawal effectively, start by completing the FORM LV-314 online today.

Nonresidents with a filing requirement will file Form IN-111, Vermont Income Tax Return and Schedule IN-113, Income Adjustment Calculations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.