Loading

Get Summary Of Child Care Expenses For Calendar Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Summary Of Child Care Expenses For Calendar Year online

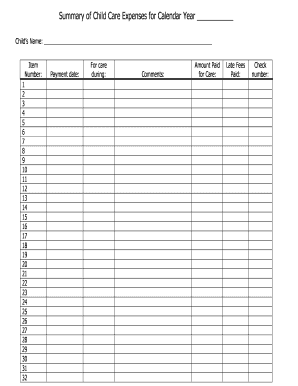

Filling out the Summary Of Child Care Expenses For Calendar Year form is essential for accurately reporting and managing your child care costs. This guide will provide you with clear, step-by-step instructions to complete the form efficiently.

Follow the steps to complete the Summary Of Child Care Expenses for Calendar Year

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Fill in your child’s name in the designated space at the top of the form.

- For each item of expense, list its item number from 1 to 32, as applicable.

- Enter the payment date for each child care expense in the corresponding field.

- Indicate the period during which care was provided for each entry.

- Add comments, if necessary, to provide additional details about each expense.

- Record the amount paid for care in the ‘Amount Paid for Care’ field for each entry.

- If applicable, note any late fees paid in the designated field.

- Enter the check number used for the payment in the ‘Check Number’ section.

- Calculate the subtotal of all amounts paid for care.

- Include any other payments made, such as deposits or supply fees, in the 'Other payments' field.

- Total all expenses to arrive at the final amount in the TOTAL section.

- Sign the form as the parent or guardian in the designated area.

- If required, have the child care provider sign the form as well.

- Date the form upon completion.

- Finally, save your changes, download the form, print it, or share it as necessary.

Complete your Summary Of Child Care Expenses online today for a smooth reporting experience.

To receive the credit for Child and Dependent Care Expenses, the expenses had to have been paid for care to be provided so that you (and your spouse, if filing jointly) could work or look for work. If both spouses do not show "earned income" (W-2's, business income, etc.), you generally cannot claim the credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.