Loading

Get Business Registration Information Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Registration Information Form online

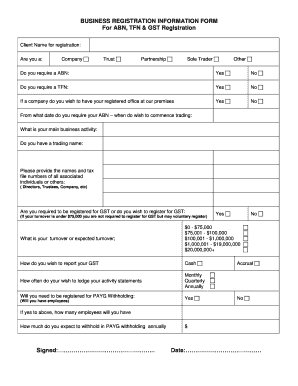

Filling out the Business Registration Information Form online is a crucial step for individuals and entities looking to officially establish their business operations. This guide will provide you with clear instructions on how to complete each section of the form, ensuring you have all the necessary information ready.

Follow the steps to successfully complete the Business Registration Information Form.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter your client name for registration in the designated field. Ensure this matches the official name of your business.

- Select your business structure by choosing one of the provided options: Company, Trust, Partnership, Sole Trader, or Other. Make sure to review the definitions if you are uncertain.

- Indicate whether you require an Australian Business Number (ABN) by selecting 'Yes' or 'No'. This is crucial for legal and tax purposes.

- Specify if you need a Tax File Number (TFN) by selecting 'Yes' or 'No'. A TFN is important for tax processes.

- If you are registering a company, indicate if you wish to have your registered office at the premises provided. Choose 'Yes' or 'No'.

- State the date from which you require your ABN to be effective, signifying when you wish to commence trading.

- Describe your main business activity clearly to give an overview of your operations.

- If you have a trading name separate from your registered name, please provide it in the field specified.

- List the names and Tax File Numbers of all associated individuals, including directors, trustees, and company representatives.

- Determine if you need to register for Goods and Services Tax (GST) by selecting the appropriate option, considering your annual turnover.

- Choose your expected turnover from the provided ranges to help determine your GST registration requirements.

- Indicate your preferred method of reporting GST: Cash or Accrual.

- Choose how often you wish to lodge your activity statements: Monthly, Quarterly, or Annually.

- If you expect to have employees, state if you need to be registered for PAYG Withholding by selecting 'Yes' or 'No'.

- If applicable, indicate the number of employees you expect to have and estimate the amount you will withhold annually.

- Sign the form electronically, ensuring your signature is clear and identifiable.

- Enter the date of completion next to your signature.

- Once all fields are filled correctly, you can save your changes, download a copy, print the form, or share it as required.

Complete your Business Registration Information Form online today to establish your business effectively.

Note: Your company registration number is the state registration number you were issued when you registered for a license to do business in your home state. This can be found on your registration documents or any documents you receive from the registrar such as account reminders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.