Loading

Get Treasurydirect Fs 5511 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TreasuryDirect FS 5511 online

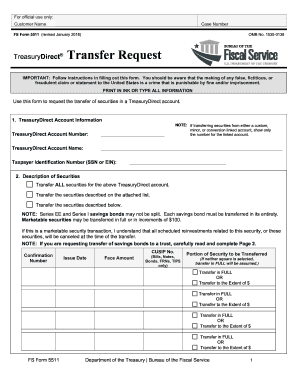

The TreasuryDirect FS 5511 form is essential for transferring securities within a TreasuryDirect account. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully fill out the FS 5511 form online.

- Click the ‘Get Form’ button to access the TreasuryDirect FS 5511 and open it for editing.

- In the first section, TreasuryDirect Account Information, enter your TreasuryDirect Account Number, Account Name, and Taxpayer Identification Number (either Social Security Number or Employer Identification Number). Note that if transferring securities from a custom, minor, or conversion linked account, you should only enter the linked account number.

- Proceed to the Description of Securities section. Indicate whether you wish to transfer ALL securities, some described in an attached list, or a specified amount of certain securities. Each choice will have specific checkboxes to select.

- If you select to transfer specific securities, provide the necessary details such as Confirmation Number, CUSIP Number, Issue Date, Face Amount, and indicate if the transfer is in FULL or to the extent of a specified dollar amount where applicable.

- In the Transfer to Another TreasuryDirect Account section, provide the recipient's TreasuryDirect Account Number, Account Name, and if applicable, Taxpayer Identification Number. Make sure to attest whether the transfer is between spouses or in relation to a divorce by checking the appropriate box.

- If transferring securities to a Financial Institution or Brokerage Firm, fill out the Routing Number, Financial Institution Wire Name, Agent or Broker Name and Phone Number, and any special handling instructions. Remember to note whether this transfer is tied to a spousal relationship.

- In the Signatures and Certifications section, ensure all parties sign the form in the presence of a certifying officer. Note that a notary public cannot certify this form. Collect necessary contact details such as daytime telephone number, mailing address, and email addresses.

- Once all fields are completed, review the form for accuracy. You can then save changes, download, print, or share the form as necessary.

Start your TreasuryDirect FS 5511 form online today to ensure your securities transfer is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Withdrawing U.S. Treasury bonds before maturity can result in penalties, which typically include forfeiting a portion of the interest earned. This penalty serves to discourage early withdrawals and helps maintain the investment's intended term. Be sure to consider the implications before making a decision on your investment in Treasury bonds.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.