Loading

Get Executor Of Estate Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Executor Of Estate Form online

Filling out the Executor Of Estate Form is an important step in managing an estate. This guide will walk you through the process of completing the form online, ensuring that you understand each component and can submit it with confidence.

Follow the steps to complete the Executor Of Estate Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

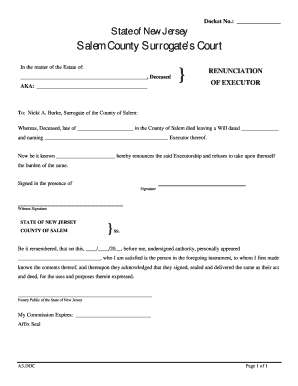

- Begin by entering the Docket Number in the designated field at the top of the form. This number is necessary for the court's reference and tracking of the estate case.

- In the section labeled 'In the matter of the Estate of,' provide the full name of the deceased person, ensuring accuracy to avoid complications.

- Fill in the 'AKA' section with any known aliases of the deceased. This information helps clarify the identity of the person mentioned.

- Under the 'RENUNCIATION OF EXECUTOR' heading, clearly state the full name of the person who is renouncing their right to serve as executor in the space provided.

- Indicate the location of death in the specified area as it relates to the County of Salem.

- Next, record the date of the Will in the space provided, ensuring that it is legible and accurate.

- In the section naming the executor, input the full name of the person originally designated as the executor of the estate.

- The person renouncing their role should sign the form in the designated area, confirming their decision to decline the executorship.

- A witness must sign the form as well, indicating that they observed the renunciation. This signature lends credibility to the process.

- Finally, the form must be completed by a Notary Public. Ensure that they sign and provide their commission expiration along with the official seal.

- Once all fields are filled out completely and accurately, you can save your changes. Download the completed form, print it, or share it as needed to submit it to the appropriate authorities.

Complete your Executor Of Estate Form online today to ensure a smooth process.

Typically, the probate court will find executor fees reasonable if it aligns with what people have received in the past as compensation in that area. This notion means that if executor fees were typically 1.5%, then 1.5% would be considered reasonable, and 3% may be unreasonable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.