Loading

Get Fs Form 4094 - Treasurydirect 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FS Form 4094 - Treasurydirect online

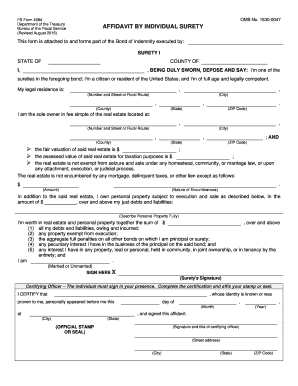

Filling out the FS Form 4094 - Treasurydirect is essential for individuals acting as sureties on a bond of indemnity. This guide will walk you through each section of the form, providing clear instructions to help you complete it confidently online.

Follow the steps to successfully fill out the FS Form 4094 - Treasurydirect.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Complete the 'Surety I' section by entering your full name and confirming your status as a surety. Indicate your citizenship status and age, then fill in your legal residence, including street address, city, county, state, and ZIP code.

- Provide the details of the real estate you own by filling in the property address, including street number, city, county, state, and ZIP code. State the fair market value and the assessed value for taxation purposes.

- Review and confirm that the real estate is not exempt from legal seizure, and disclose any encumbrances or liens related to the property.

- List your personal property that is subject to execution and sale, along with its total value. Ensure this amount exceeds your liabilities.

- Calculate and report your total worth in real estate and personal property, ensuring it accounts for all debts, exemptions, and other interests that may apply.

- Indicate your marital status by selecting either 'Married' or 'Unmarried.'

- Provide your signature in the designated area to confirm the information is accurate.

- The certifying officer must complete their certification by confirming your identity and affixing their stamp or seal, along with their signature and title.

- Finalize by saving your changes, and consider downloading, printing, or sharing the completed form as necessary.

Complete your documents online today to ensure a smooth filing process.

Yes, if you earn interest on your I Bonds, you will receive a 1099 form from TreasuryDirect. This form will detail the interest earned, making it easier for you to report on your tax return. Keep in mind that interest on I Bonds is taxable, even if you choose to defer reporting it. Make sure to review your forms carefully during tax season to ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.