Loading

Get Tx Comptroller 00-750 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 00-750 online

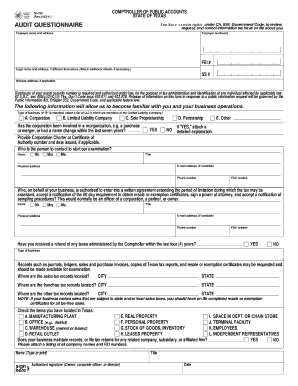

This guide provides comprehensive instructions on how to complete the TX Comptroller form 00-750 online. By following these steps, you can ensure that your audit questionnaire is filled out accurately and efficiently.

Follow the steps to accurately complete the TX Comptroller 00-750 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxpayer name and address in the required fields. Make sure to include any relevant taxpayer number(s) and the federal employer identification number (FEI #). If your legal name or address differs from the one provided, please attach additional sheets as necessary.

- Complete the section regarding the type of business by selecting the appropriate option. Options include Corporation, Limited Liability Company, Sole Proprietorship, Partnership, or Other. If 'Limited Liability Company' is chosen, attach a list of all LLC members.

- If your corporation has undergone a reorganization or name change in the past seven years, indicate this and provide the Corporation Charter or Certificate of Authority number and the date it was issued.

- Fill in the contact person's name and title for the examination process. Provide their email address, physical address, phone number, and fax number if available.

- Designate an authorized individual on behalf of your business who can extend the period of limitation for tax assessments, accept notifications, and sign agreements. Enter their details similarly as in step 5.

- Indicate whether you have received a refund of any taxes managed by the Comptroller within the last four years by checking 'YES' or 'NO'.

- Complete the locations of your sales tax records, franchise tax records, and any other tax records, ensuring to provide city and state information.

- Select the items located in Texas by checking the applicable boxes, including manufacturing plants, offices, warehouses, and more.

- If applicable, list any related companies or subsidiaries that maintain records or file tax returns on behalf of your business, and attach a comprehensive list with their names and FEI numbers.

- Sign and date the form, ensuring the authorized signature is from an owner, corporate officer, or director.

- Review your entries for accuracy before finalizing. You can now save changes, download the completed form, print it, or share it as needed.

Complete your TX Comptroller 00-750 form online today to ensure compliance and efficiency in your business operations.

The main job of the Texas Comptroller is to oversee the state's finances and ensure accurate revenue collection. This role involves monitoring state budgets, forecasting revenues, and providing financial reports to citizens and officials. By grasping the essential functions of the TX Comptroller 00-750, you will be better equipped to understand how these activities support Texas's economic health.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.