Loading

Get Alternate Payee Distributi - Fidelity Investments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alternate Payee Distribution - Fidelity Investments online

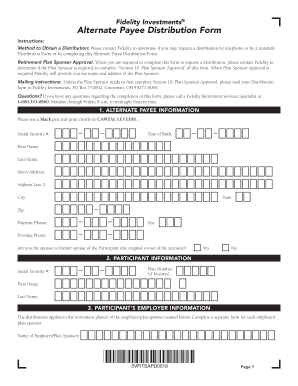

Filling out the Alternate Payee Distribution form from Fidelity Investments can seem complex, but this guide will help you navigate each section with ease. Follow these step-by-step instructions to ensure a smooth submission process.

Follow the steps to complete the form accurately.

- Press ‘Get Form’ button to obtain the form and access it in the online editor.

- Fill in the Alternate Payee Information section by entering your Social Security number, date of birth, name, address, and phone numbers. Ensure that you use a black pen and print clearly in capital letters.

- Complete the Participant Information section with the Participant's Social Security number and plan number if you know it. Include their first and last name.

- Provide the Participant’s Employer Information by writing the name of the employer or plan sponsor for whom you are requesting the distribution.

- Indicate the Reason for Distribution and choose the appropriate option from the list. If applicable, these may include hardship withdrawals or eligibility criteria related to the Participant.

- Select your preferred Distribution Options. You may choose to take a full or partial withdrawal, specify sources or amounts, and opt for systemic withdrawal plans or specific dollar methods.

- Specify the Form of Payment you prefer, whether payable to you, as a direct rollover, or to an existing retirement plan. Make sure to provide the name of the receiving investment provider if applicable.

- Complete the Income Tax Withholding section, indicating whether you elect not to withhold taxes or specify the percentage you wish to withhold for federal and state taxes.

- Sign and date the form in the Alternate Payee Signature section. Include a signature guarantee if required based on the distribution amount and conditions.

- If necessary, complete the Plan Sponsor Approval section. Contact Fidelity or the employer to determine if approval is required. Ensure that the form is signed and dated by the appropriate party.

- After completing all sections, review the form for accuracy. Then, save changes, download, print, or share the form according to your needs.

Complete your distribution request online for a seamless experience.

For purposes of the QDRO provisions, an alternate payee cannot be anyone other than a spouse, former spouse, child, or other dependent of a participant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.