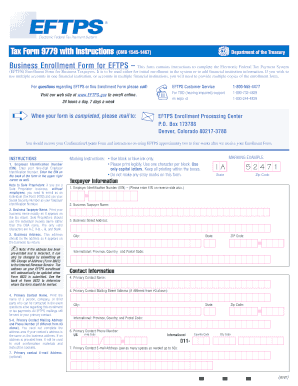

Get Tax Bformb 9779 With Instructions Omb 1545-1467

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Tax BFormb 9779 With Instructions OMB 1545-1467 online

How to fill out and sign Tax BFormb 9779 With Instructions OMB 1545-1467 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Getting a legal specialist, creating a scheduled visit and coming to the business office for a private conference makes finishing a Tax BFormb 9779 With Instructions OMB 1545-1467 from start to finish tiring. US Legal Forms enables you to rapidly generate legally-compliant papers based on pre-built web-based templates.

Prepare your docs within a few minutes using our simple step-by-step instructions:

- Get the Tax BFormb 9779 With Instructions OMB 1545-1467 you require.

- Open it up using the cloud-based editor and begin editing.

- Fill out the blank fields; engaged parties names, addresses and numbers etc.

- Customize the blanks with exclusive fillable fields.

- Put the particular date and place your e-signature.

- Click Done following twice-examining all the data.

- Download the ready-produced papers to your device or print it out like a hard copy.

Rapidly produce a Tax BFormb 9779 With Instructions OMB 1545-1467 without needing to involve professionals. We already have over 3 million people making the most of our unique collection of legal forms. Join us right now and get access to the top catalogue of web samples. Test it yourself!

How to edit Tax BFormb 9779 With Instructions OMB 1545-1467: customize forms online

Put the right document management capabilities at your fingertips. Execute Tax BFormb 9779 With Instructions OMB 1545-1467 with our trusted solution that combines editing and eSignature functionality}.

If you want to complete and certify Tax BFormb 9779 With Instructions OMB 1545-1467 online without hassle, then our online cloud-based option is the way to go. We offer a wealthy template-based library of ready-to-use paperwork you can edit and complete online. Moreover, you don't need to print out the document or use third-party solutions to make it fillable. All the necessary features will be readily available at your disposal once you open the file in the editor.

Let’s go through our online editing capabilities and their key features. The editor features a self-explanatory interface, so it won't require much time to learn how to use it. We’ll take a look at three main parts that allow you to:

- Modify and annotate the template

- Organize your paperwork

- Prepare them for sharing

The top toolbar comes with the features that help you highlight and blackout text, without pictures and image aspects (lines, arrows and checkmarks etc.), sign, initialize, date the form, and more.

Use the toolbar on the left if you would like to re-order the form or/and delete pages.

If you want to make the template fillable for others and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

In addition to the functionality mentioned above, you can shield your file with a password, add a watermark, convert the file to the required format, and much more.

Our editor makes completing and certifying the Tax BFormb 9779 With Instructions OMB 1545-1467 very simple. It enables you to make virtually everything when it comes to dealing with forms. Moreover, we always make sure that your experience editing documents is secure and compliant with the main regulatory standards. All these factors make utilizing our solution even more enjoyable.

Get Tax BFormb 9779 With Instructions OMB 1545-1467, make the necessary edits and tweaks, and download it in the preferred file format. Give it a try today!

- If you indicated the wrong tax form or tax type, contact the IRS in 10 business days to have a correction made. - If you have more than one EFTPS® enrollment and used the wrong account, contact your financial institution about denying the payment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.