Loading

Get Questions All Taxpayers Cross Reference To Pages In The 2013 Edition Of Thetaxbook, 1040 Edition

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Questions All Taxpayers Cross Reference To Pages In The 2013 Edition Of TheTaxBook, 1040 Edition online

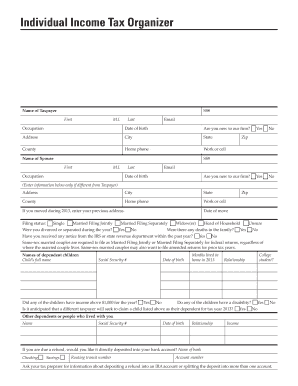

Filling out the Questions All Taxpayers Cross Reference To Pages In The 2013 Edition Of TheTaxBook, 1040 Edition online can help streamline your tax preparation process. This guide provides users with clear and supportive instructions to effectively complete the form, ensuring all necessary information is accurately documented.

Follow the steps to fill out the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter personal information, including your and your spouse's names, Social Security numbers, and contact details. Make sure to check for any updates in your contact status.

- Indicate your filing status by selecting the appropriate option, whether you are single, married filing jointly, or another category.

- Answer questions regarding major life events for the year, such as marriages, separations, or any children born or adopted.

- Provide dependent information, including names, Social Security numbers, and their ages. Be sure to clarify any income or specific considerations for your dependents.

- Review all questions carefully, marking 'Yes' or 'No' as applicable. Pay close attention to details regarding income and deductions.

- If eligible for direct deposit, enter banking information for your refund. Confirm that the account details are correct to avoid processing delays.

- Finish by reviewing all sections of the form for completeness and clarity. After ensuring everything is accurate, you can save, download, print, or share the filled document.

Start filling out your tax documents online now!

Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.