Loading

Get Frm-ira-dist-9-10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FRM-IRA-DIST-9-10 online

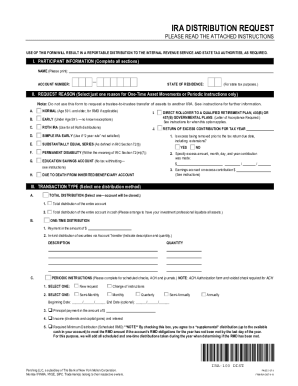

This guide provides detailed instructions on how to effectively fill out the FRM-IRA-DIST-9-10 form online for your IRA distribution request. By following these steps, users can ensure a smooth and accurate submission process.

Follow the steps to complete the FRM-IRA-DIST-9-10 form accurately.

- Click the ‘Get Form’ button to obtain the FRM-IRA-DIST-9-10 form and access it in the online editor.

- In the Participant Information section, enter your personal details including your name and account number, ensuring accuracy.

- Select the Request Reason that applies to your situation, remembering to consult your tax advisor regarding possible taxes and penalties.

- Choose the Transaction Type by selecting the method of distribution that fits your needs, whether it's a total distribution, one-time distribution, or periodic instructions.

- If applicable, complete the Tax Withholding Election to specify your withholding preferences for federal and state taxes.

- In the Method of Delivery section, indicate how you would like to receive your distribution, providing any necessary details for alternate payees or bank information if wired.

- Select Standing Instructions if you want these preferences to apply to future transactions.

- Review the Fees section and indicate how fees should be handled, if applicable.

- Finally, sign the form to confirm that you have read and understood the instructions, and submit your completed form to your investment professional.

Complete your IRA distribution request online today to ensure timely processing and adherence to your financial needs.

You stop paying Required Minimum Distributions (RMD) from your IRA once you reach the age of 72. However, if you are dealing with inherited IRAs under the FRM-IRA-DIST-9-10, the rules may differ. It's essential to consult financial advisors or tools offered by platforms like uslegalforms for tailored advice on your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.