Loading

Get Mortgage Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Loan Application online

Filling out a mortgage loan application online can seem daunting, but understanding each component can simplify the process. This guide will walk you through the necessary steps, ensuring you provide all required information accurately and efficiently.

Follow the steps to complete your Mortgage Loan Application with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the Mortgage Loan Application and begin the process of filling it out online.

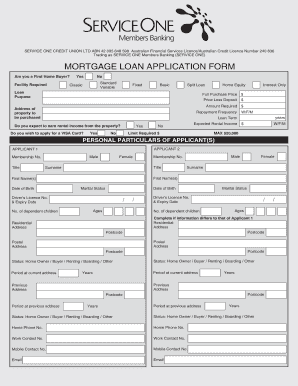

- Indicate if you are a first home buyer by selecting 'Yes' or 'No.' Choose the facility type required, such as Standard, Variable, or Fixed, and specify the loan purpose along with the full purchase price and amount required.

- Provide the address of the property you intend to purchase, along with the desired repayment frequency and loan term.

- Specify if you expect to earn rental income from the property and if you wish to apply for a VISA card, including any limit required.

- Fill out the personal particulars of all applicants, including titles, names, driver’s license numbers, ages, and marital statuses. Include details on residential and previous addresses.

- Provide your employment details, including occupation, status, employer information, and duration in the current position.

- Report your income details, listing your net income and any additional income sources. Ensure that all supporting evidence is prepared, as required.

- Detail your assets and liabilities, including home ownership, motor vehicles, real estate, savings, and any outstanding loans. Make sure to indicate repayment frequencies as needed.

- Complete the applicant declaration, answering questions regarding any past bankruptcies or legal proceedings, and provide your consent for SERVICE ONE to process your application along with your signatures and dates.

- After completing the application, review all entries for accuracy. Save changes, download, print, or share the form as needed for submission.

Start your Mortgage Loan Application online today and take the first step towards securing your loan.

The entire mortgage process has several parts, including getting pre-approved, getting the home appraised, and getting the actual loan. In a normal market, this process takes about 30 days on average, says Fite. During high-volume months, it can take longer an average of 45 to 60 days, depending on the lender.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.