Loading

Get In Form Wh-4 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form WH-4 online

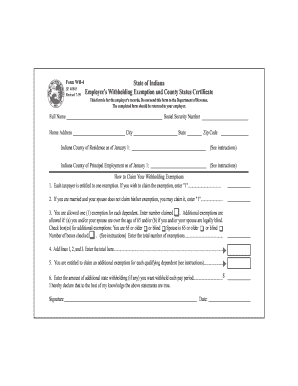

The IN Form WH-4 is essential for employees subject to Indiana state and county income taxes. This guide provides a clear and supportive framework to help users complete the form accurately online.

Follow the steps to successfully fill out the IN Form WH-4 online.

- Click ‘Get Form’ button to access the IN Form WH-4 and open it for editing.

- Begin by entering your full name, social security number, and home address in the designated fields. Ensure that the information is accurate and clearly presented.

- Input your Indiana county of residence as of January 1 and your county of principal employment as of the same date. If you were not residing or employed in Indiana at that time, indicate 'not applicable' in the fields provided.

- Claim your withholding exemptions. For line 1, enter '1' if you are claiming yourself as an exemption. For line 2, enter '1' if you are married and your spouse does not claim their exemption.

- On line 3, you may enter the number of dependent exemptions you are entitled to claim. Additionally, check any boxes for further exemptions if applicable, such as age over 65 or blindness.

- After entering the exemptions from lines 1, 2, and 3, total them on line 4 and indicate the sum in the provided box.

- If applicable, add any additional dependent exemptions on line 5 and complete the amount of additional state withholding, if desired, on line 6.

- Review all entered information for accuracy. Once confirmed, you may save the changes, download, print, or securely share the completed form with your employer.

Complete your IN Form WH-4 online today to ensure accurate withholding!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can request a copy of your IN Form WH-4 from your employer or by accessing your records available through payroll systems. If you filed the form for a previous year and need it for reference, you can also access it via your tax preparer or utilize platforms like US Legal Forms for a fresh copy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.