Loading

Get Texasaver Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texasaver Com online

This guide will walk you through the step-by-step process of filling out the Texasaver Com form. Designed to be user-friendly, it ensures that you understand each section and requirement for a successful submission.

Follow the steps to complete the Texasaver Com form accurately.

- Click ‘Get Form’ button to obtain the form and access it using your preferred method.

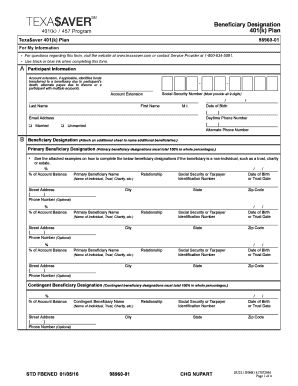

- Begin with the participant information section. Fill in your last name, first name, middle initial, social security number (ensure it includes all 9 digits), date of birth, daytime phone number, and email address. Indicate your marital status by checking either 'Married' or 'Unmarried'.

- In the beneficiary designation section, specify the primary beneficiaries. Ensure that their total share equals 100% in whole percentages. Include their name, relationship to you, social security number or taxpayer identification number, date of birth, street address, and optional phone number.

- If you have multiple primary beneficiaries, repeat step 3 for each and maintain the total percentage at 100%. Use additional sheets if necessary.

- Proceed to contingent beneficiaries. Similar to primary beneficiaries, these designations must total 100% in whole percentages. Fill in the required details as per the form.

- After completing the beneficiary designations, review all entries to ensure accuracy. Make sure both primary and contingent beneficiaries are clearly specified.

- Finally, sign and date the form in the designated area. This confirms that you understand and agree to the beneficiary designations outlined in the form.

- Once everything is completed, you can save your changes, download the form, print it, or share it as necessary.

Start filling out your Texasaver Com form online today to ensure your beneficiaries are designated accurately.

Advantages & Disadvantages of 457(b) and 457(k) Plans ProsConsTaxes on your contributions, interest and dividends are deferred until you withdraw money.The maximum annual limit for contributions is $45,000 (including all catch-up contributions); far below the limit for total 401(k) contributions.3 more rows • Sep 14, 2020

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.