Loading

Get Interactive Form 1023

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Interactive Form 1023 online

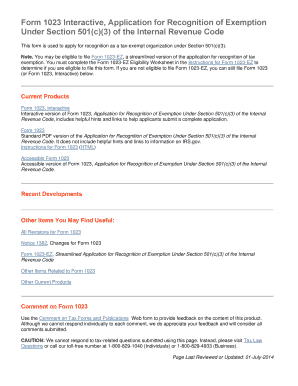

The Interactive Form 1023 is an essential document for organizations seeking recognition as a tax-exempt entity under Section 501(c)(3). This guide provides a clear and supportive step-by-step approach to help users complete the form effectively.

Follow the steps to complete the Interactive Form 1023 online.

- Press the ‘Get Form’ button to obtain the interactive form and open it in your preferred editor.

- Begin by filling in the organization’s legal name and ensuring it matches the name registered with the IRS. Double-check for accuracy.

- Complete the section regarding your organization’s purpose. This should clearly outline the mission and goals that align with tax-exempt purposes under Section 501(c)(3).

- Provide information about the organizational structure, including whether it is a corporation, trust, or other entity type. Include names and titles of officers and directors.

- Outline your organization’s activities and how they align with its purpose. Detail current and planned programs that advance your mission.

- Fill out the financial information section, which needs your budget, income projections, and fundraising plans. Make sure to provide realistic and honest estimates.

- Review all completed sections for clarity and accuracy. Utilize any provided hints or links within the interactive form for guidance.

- Once satisfied with your responses, save your changes. You can then download, print, or share the completed form per your needs.

Start completing your Interactive Form 1023 online today to ensure your organization's eligibility for tax-exempt status.

Form 1023-EZ is the streamlined version of Form 1023, Application for Recognition of Exemption Under Section 501(c) (3) of the Internal Revenue Code. Any organization may file Form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.