Get Treasury Form 8885 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury Form 8885 online

This guide provides step-by-step instructions on how to fill out the Treasury Form 8885 online, ensuring you understand each component to efficiently claim your Health Coverage Tax Credit. Whether you are a first-time user or have prior experience, this guide aims to support you through the process.

Follow the steps to complete your Treasury Form 8885 online.

- Press the 'Get Form' button to obtain the Treasury Form 8885 and open it for editing.

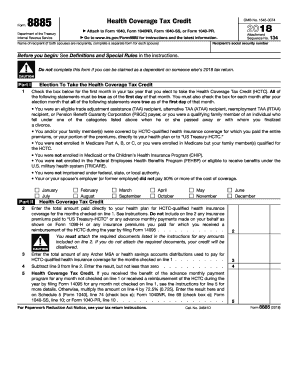

- Begin by entering the recipient’s social security number in the designated field at the top of the form.

- Provide the name of the recipient. If both spouses qualify, ensure you complete a separate form for each individual.

- In Part I, check the box corresponding to the first month you wish to elect the Health Coverage Tax Credit (HCTC). Make sure all eligibility statements apply to your situation.

- For each month following your election month, check the box indicating continued eligibility.

- In Part II, enter the total amount paid to your health plan for HCTC-qualified coverage for the months checked in Part I. Remember not to include any payments made to 'US Treasury-HCTC' or advance payments shown on Form 1099-H.

- If applicable, enter the total amounts from any Archer MSA or health savings accounts used to pay for HCTC-qualified coverage.

- Calculate the difference by subtracting line 3 from line 2 and enter the result.

- If you received advance payments or reimbursements for HCTC, refer to the instructions for line 5. Otherwise, multiply the amount on line 4 by 72.5% and enter this figure as your Health Coverage Tax Credit.

- Finally, save your changes, and you can choose to download, print, or share the completed form as needed.

Complete your Treasury Form 8885 online today to ensure you receive the health coverage tax credit you deserve.

Related links form

Eligibility for the health coverage tax credit includes individuals who receive benefits from the Pension Benefit Guaranty Corporation or who are laid off from their jobs. You also must have qualified health insurance coverage for at least one month during the tax year. Your income must fall within the specified limits to qualify for the credit. Review your situation carefully to determine how Treasury Form 8885 can benefit you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.