Get Treasury Form 434

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury Form 434 online

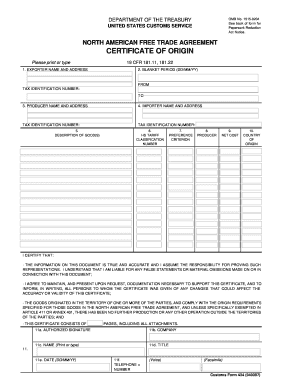

Filling out the Treasury Form 434 online is a crucial step for ensuring compliance with the North American Free Trade Agreement. This guide provides a detailed, step-by-step approach to assist users in completing the form accurately and effectively.

Follow the steps to successfully complete the Treasury Form 434 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In Field 1, enter the full legal name and address of the exporter, including the country, and their legal tax identification number.

- In Field 2, specify the blanket period by entering the dates formatted as DD/MM/YY for 'FROM' and 'TO'.

- Fill in Field 3 with the producer's full legal name, address, and their tax identification number, similar to how you completed Field 1.

- Complete Field 4 by providing the importer’s full legal name, address, and tax identification number.

- In Field 5, write a detailed description of the goods, ensuring it accurately relates to the invoice description.

- Identify the HS tariff classification number for each good in Field 6 to the appropriate digits.

- For Field 7, state the applicable preference criterion (A through F) based on the origin rules.

- In Field 8, indicate whether you are the producer of the goods by answering 'YES' or 'NO', and provide the necessary details.

- In Field 9, indicate the regional value content (RVC) status for the goods accordingly.

- Complete Field 10 by specifying the country of origin based on the respective criteria outlined.

- Finally, in Field 11, ensure that the form is signed and dated by the exporter or producer, as required.

- After completing the form, save changes, and you can then download, print, or share the form as needed.

Complete your Treasury Form 434 online today to ensure compliance and streamline your trade processes.

Related links form

The USMCA Certificate of Origin is typically filled out by the exporter or the producer of the goods. This individual or business must provide accurate information about the product and verify its origin. Completing this document is essential for accessing tariff benefits under the USMCA. For better guidance, you can refer to resources available on the US Legal Forms platform, which can also assist you with filling out the Treasury Form 434.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.