Loading

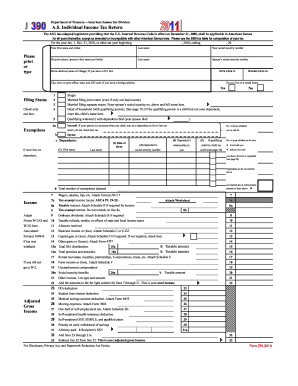

Get Treasury Form 390 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury Form 390 online

This guide provides clear and concise instructions on filling out the Treasury Form 390 online. Users of all experience levels can follow these steps to successfully complete their tax form with confidence.

Follow the steps to easily complete the Treasury Form 390.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal information. Provide your first name and initial, along with your last name and social security number. If you are filing a joint return, include your spouse’s details as well.

- Complete your contact information, including your home phone number and address. If you have a P.O. box, please indicate that and include your city, state, and ZIP code.

- Indicate whether you live in a rental home by checking 'Yes' or 'No'.

- Select your filing status by checking the appropriate box. Options include: Single, Married Filing Joint Return, Married Filing Separate Return, Head of Household, or Qualifying Widow(er).

- Fill in the exemptions section. Provide information for yourself, your spouse, and any dependents you claim, including names, social security numbers, dates of birth, and relationship to you.

- Report your income by entering wages, salaries, tips, and any other types of income in the respective fields. Attach any required forms like W-2 or 1099 if you have them.

- Complete the deductions section, providing necessary figures for adjusted gross income and any applicable deductions or credits.

- Calculate your total income tax and check if any additional tax credits apply. Fill in the related fields as needed.

- Review all entered information for accuracy. Once completed, you can choose to save changes, download, print, or share the form as needed.

Complete your Treasury Form 390 online today for a smooth tax filing experience.

Related links form

To report interest income from treasury bills, you'll need to include the interest earned on your tax return using the information from your 1099 INT. It's important to ensure that you report this income accurately to avoid potential issues with the IRS. If you require assistance with your tax documentation process, USLegalForms can guide you through using forms like the Treasury Form 390 effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.