Loading

Get Bsf189

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bsf189 online

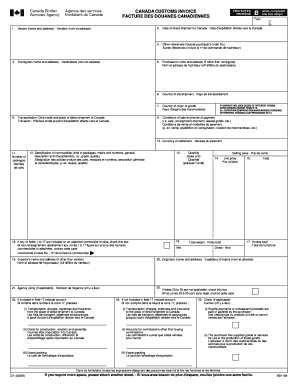

The Bsf189 form, also known as the Canada Customs Invoice, is essential for individuals or businesses importing goods into Canada. This guide provides step-by-step instructions to help users accurately fill out the form online, ensuring compliance with customs regulations.

Follow the steps to successfully complete the Bsf189 form online.

- Click the ‘Get Form’ button to obtain the Bsf189 form and open it in the editor.

- Enter the vendor's name and address in the designated section.

- Fill in the consignee's name and address to specify the recipient of the goods.

- Indicate the mode and place of the direct shipment to Canada under the transportation section.

- Specify the date of direct shipment to Canada.

- Provide any other references, including the purchaser's order number, in the relevant field.

- If the purchaser is different from the consignee, enter the purchaser's name and address.

- Fill in the country of transhipment, if applicable.

- Enter the country of origin of the goods.

- Detail the conditions of sale and terms of payment, such as sale, consignment, or leased goods.

- If the shipment includes goods of different origins, specify the origins against the items in the appropriate section.

- Indicate the currency of settlement.

- Fill in the number of packages being shipped.

- Provide a detailed specification of commodities, including type of packages, marks, numbers, and a general description.

- State the quantity of goods and be sure to specify the unit of measurement.

- If applicable, check the box if any of fields 1 to 17 are included on an attached commercial invoice.

- Fill in the commercial invoice number.

- Provide the selling price of the goods.

- Input the unit price for each item.

- Complete the total weight section, distinguishing between net and gross weight.

- Indicate the total invoice amount.

- If the exporter is different from the vendor, enter the exporter's name and address.

- Provide the originator's name and address as required.

- If applicable, indicate any agency ruling.

- If applicable, specify amounts in fields not included in field 17.

- If not included in field 17, indicate amounts for transportation charges, assembly, export packing, and other costs.

- Finally, review all entries for accuracy, then save your changes, download the completed form, and print or share as necessary.

Complete your Bsf189 form online today to ensure a smooth customs process.

A Canada invoice contains more information than a standard commercial invoice and is reviewed by the Canada Border Services Agency (CBSA). It must be filled out by one of the following parties: Exporter. Importer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.