Get Ca Boe-410-d 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA BOE-410-D online

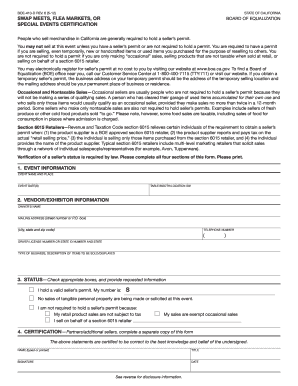

The CA BOE-410-D form is essential for vendors participating in swap meets, flea markets, or special events in California. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring you meet all required criteria.

Follow the steps to successfully complete the CA BOE-410-D form.

- Click the ‘Get Form’ button to retrieve the CA BOE-410-D and open it in your preferred online editor.

- In the 'Event Information' section, input the name of the event, its location, and the dates it will occur. This ensures your participation is accurately recorded.

- Move to the 'Vendor/Exhibitor Information' section. Here, provide your name as the owner, mailing address, telephone number, and your driver license number or state ID number along with the state of issue.

- Next, describe the nature of your business and the items you plan to sell or display. This information helps in verifying your selling qualifications.

- In the 'Status' section, check the appropriate boxes that reflect your situation regarding the seller’s permit. If you hold one, list the number. Explain your basis for not needing a permit if applicable.

- Proceed to the 'Certification' section. Type or print your name, title, and sign the form, including the date to certify that the information provided is accurate to the best of your knowledge.

- Once you have completed all sections of the form, you can save your changes, download it for your records, print it out, or share it as needed.

Complete your documents online now to ensure your event participation is properly documented.

A CDTFA audit can be triggered by several factors, including discrepancies in reported income, significant changes in sales patterns, or random selection processes. If your business has a history of errors or discrepancies, this may also raise flags for an audit. It is essential to maintain accurate records and proper tax filings to minimize audit risks, including using forms like the CA BOE-410-D when necessary.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.