Loading

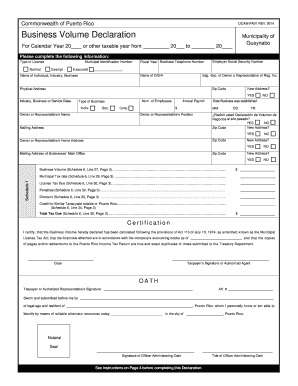

Get Volume Of Business Declaration Puerto Rico

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Volume Of Business Declaration Puerto Rico online

Filling out the Volume Of Business Declaration for Puerto Rico is an important step for businesses to report their annual revenue and comply with local tax regulations. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Volume Of Business Declaration online

- Press the ‘Get Form’ button to access the Volume Of Business Declaration document and open it in your preferred editor.

- Indicate the type of license you hold by selecting 'Normal' or 'Exempt' from the options provided.

- Enter your Municipal Identification Number, Employer Social Security Number, and your business's fiscal year telephone number.

- Fill in the name of your business and the name of the individual, industry, or business representative.

- Provide the physical address of your business, including the zip code. If there is a new address, make sure to check 'YES' and provide the new information.

- List the industry, business, or service class and the number of employees.

- Specify the type of business, whether it is individual, society, or corporation.

- Input your annual payroll in the designated field.

- Enter the status and name of the owner or the representative and their position in the business.

- Indicate the date the business was established, and provide both the mailing address and home address for the owner or representative, noting any new address changes.

- Provide the business volume based on Schedule 6, Line 27, including additional schedules if applicable.

- Complete the municipal tax rate details and calculations from Schedule 6, including license tax due, any penalties, discounts, and total tax due.

- Certify that the declared business volume aligns with the provisions of the Municipal License Tax Act and that the attached financials comply with your accounting records.

- Sign and date the declaration, ensuring that, if required, it is sworn before a notary or authorized officer.

- Review the entire form for accuracy and completeness before submission.

- Once finalized, save your changes, download the form as needed, and prepare to share or print the declaration for your records.

Complete your Volume Of Business Declaration online to ensure accurate reporting and compliance.

Puerto Rico sales tax details Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.