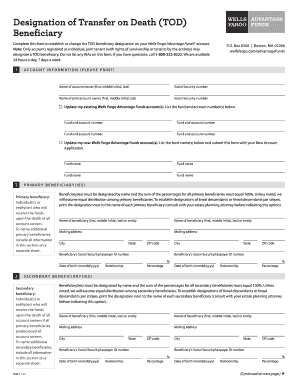

Get Wells Fargo Designation Of Transfer On Death (tod) Beneficiary 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Wells Fargo Designation of Transfer on Death (TOD) Beneficiary online

How to fill out and sign Wells Fargo Designation of Transfer on Death (TOD) Beneficiary online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax, legal, commercial along with other electronic documents require a high level of adherence to the law and safeguarding. Our forms are refreshed regularly in alignment with the most recent legislative modifications. Additionally, with us, all information you provide in the Wells Fargo Designation of Transfer on Death (TOD) Beneficiary is securely protected against loss or damage using state-of-the-art encryption.

The suggestions below will assist you in completing the Wells Fargo Designation of Transfer on Death (TOD) Beneficiary swiftly and effortlessly:

Our platform enables you to manage the entire process of filling out legal documents online. Consequently, you save hours (if not days or even weeks) and eliminate unnecessary costs. From this point on, complete the Wells Fargo Designation of Transfer on Death (TOD) Beneficiary from the convenience of your home, office, or even while traveling.

- Launch the template in our comprehensive online editor by clicking Get form.

- Complete the required fields that are highlighted in yellow.

- Click the green arrow labeled Next to navigate from one section to another.

- Utilize the electronic signature tool to affix your digital signature to the document.

- Add the date.

- Thoroughly review the entire electronic document to ensure that you have not overlooked any critical details.

- Press Done and save the completed form.

How to modify Wells Fargo Designation of Transfer on Death (TOD) Beneficiary 2011: personalize forms online

Experience a hassle-free and paperless method of operating with Wells Fargo Designation of Transfer on Death (TOD) Beneficiary 2011. Leverage our dependable online service and save a significant amount of time.

Crafting every file, including Wells Fargo Designation of Transfer on Death (TOD) Beneficiary 2011, from the ground up takes excessive time, so having a reliable solution of pre-existing document templates can greatly enhance your efficiency.

But dealing with them can be challenging, particularly when it pertains to files in PDF form. Luckily, our extensive library includes a built-in editor that enables you to swiftly complete and modify Wells Fargo Designation of Transfer on Death (TOD) Beneficiary 2011 without needing to leave our website, so you won't lose time executing your paperwork. Here’s how to utilize our tools on your file:

Whether you aim to complete editable Wells Fargo Designation of Transfer on Death (TOD) Beneficiary 2011 or any other document in our collection, you are on the correct path with our online document editor. It's simple and secure, requiring no specialized technical background. Our web-based service is engineered to manage practically everything related to file editing and execution.

Stop relying on obsolete methods for managing your documents. Opt for a more efficient solution to help streamline your tasks and reduce reliance on paper.

- Step 1. Locate the necessary document on our site.

- Step 2. Click Get Form to launch it in the editor.

- Step 3. Utilize specialized editing features that allow you to insert, eliminate, remark, and emphasize or obscure text.

- Step 4. Create and attach a legally-binding signature to your document using the sign option from the top menu.

- Step 5. If the document arrangement doesn’t appear as you desire, use the tools on the right to remove, add, and organize pages.

- Step 6. Include fillable fields so that others can be invited to finalize the document (if necessary).

- Step 7. Distribute or send the document, print it out, or choose the format in which you wish to receive the document.

To add a TOD to your bank account, mostly you'll need to contact your bank either online or in person. They will provide you with the appropriate form and guide you through the process of designating the beneficiary. Utilizing the Wells Fargo Designation of Transfer on Death (TOD) Beneficiary can simplify your estate planning and ensure your assets are handled according to your wishes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.