Loading

Get Irs W-9 2018-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-9 online

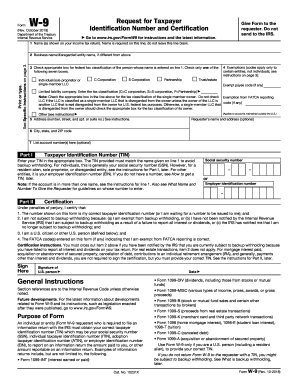

The IRS W-9 form is essential for providing your taxpayer identification number (TIN) to entities requesting it for reporting purposes. This guide offers a clear, step-by-step approach to filling out the form online, ensuring that users of all experience levels can complete it accurately.

Follow the steps to fill out the IRS W-9 online successfully.

- Press the ‘Get Form’ button to access the W-9 form and open it in the editor.

- In line 1, enter your name as it appears on your income tax return. Do not leave this line blank; ensure the name is clearly printed or typed.

- If you have a business name or a disregarded entity name, fill in line 2 with this information.

- On line 3, check the appropriate box that indicates your federal tax classification. This includes options like Individual/Sole Proprietor, Corporation, or Partnership. Ensure to only select one box.

- If applicable, enter any exemptions on line 4, noting that these codes only apply to certain entities.

- Provide your complete address in line 5, including street numbers and apartment or suite numbers as necessary.

- Fill in the city, state, and ZIP code in line 6.

- If you have account numbers applicable to your TIN, optionally list them in line 7.

- In Part I, enter your taxpayer identification number (TIN) in the appropriate box, which can be your SSN or EIN depending on your classification.

- Move to Part II, and read the certification statement. To finalize, sign and date the form, indicating that the information you have provided is accurate.

- Once the form is completed, you have the option to save changes, download, print, or share the W-9 form as needed.

Complete your IRS W-9 form online today to ensure accurate reporting for your tax purposes.

Obtaining an IRS W-9 form for your business is straightforward. You can download the form directly from the IRS website or use platforms like uslegalforms, which offer easy access to the latest form. After downloading, simply fill it out with your business information and provide it to the requesting party.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.