Loading

Get Formulir Pajak Retribusi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulir Pajak Retribusi online

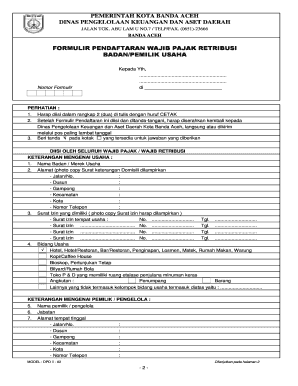

Filling out the Formulir Pajak Retribusi online is an essential step for individuals and businesses in Banda Aceh to comply with local tax regulations. This guide provides detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Formulir Pajak Retribusi online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the ‘Nomor Formulir’ in the designated field. This number is essential for identification purposes.

- Fill in the detail section titled ‘KETERANGAN MENGENAI USAHA.’ This includes providing the name of the business, business address, and contact information.

- Input the ‘KETERANGAN MENGENAI PEMILIK / PENGELOLA’ section with the owner's or manager's details, including name, job title, and residential address.

- Complete the required information regarding business licenses, making sure to include photocopies of each applicable license.

- If applicable, fill out the specific fields related to the type of business, such as hotels, restaurants, or entertainment, ensuring all required data is provided accurately.

- Review the entire form for accuracy. It is vital to ensure that all required fields are completed and that the information matches your documents.

- Once all fields are filled out, proceed to save your changes, and then you can download, print, or share the completed form as needed.

Start completing your Formulir Pajak Retribusi online today to ensure compliance with local tax regulations.

e-SPTPD (Eletronik Surat Pemberitahuan Pajak Daerah) adalah Suatu sistem aplikasi yang dibangun berbasis web yang dikembangkan sebagai sarana wajib pajak untuk mendaftarkan, membayar dan melaporkan kewajiban pajak daerahnya secara online serta dapat diakses dimana saja.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.