Get In Vra/fha

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN VRA/FHA online

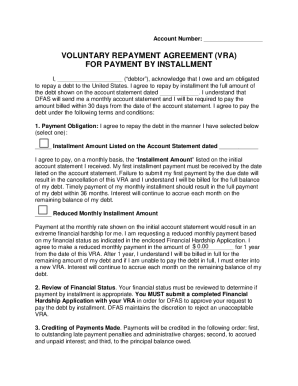

Filling out the IN Voluntary Repayment Agreement (VRA) and Financial Hardship Application (FHA) is an essential step for individuals seeking to initiate monthly installment payments. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete your VRA/FHA form accurately.

- Press the ‘Get Form’ button to access the VRA/FHA form in the online editor.

- Complete the personal information section. This includes your name, birth date, and contact details. Ensure accuracy to avoid delays.

- Fill out the financial hardship section. Provide details about your income and necessary expenses, including proof of income and monthly expenses.

- Select your payment obligation. Choose either the full installment amount or a reduced monthly installment amount and provide necessary details.

- Review the terms and conditions of the VRA to ensure understanding of your obligations regarding payment schedules and potential penalties.

- Sign and date the form in the designated areas, confirming that you have read and understood the terms.

- Attach all required supporting documents and ensure that they are included with the VRA/FHA form.

- Finally, save your changes, and choose to either download, print, or share the completed form as needed.

Complete your IN VRA/FHA form online today for a smoother repayment process.

Manual underwriting remains available for certain FHA loans, providing borrowers who may not fit traditional criteria with a viable option. It allows lenders to evaluate the overall creditworthiness of a borrower more effectively. This flexibility is particularly beneficial in IN VRA/FHA scenarios, where standard automated systems may not account for unique financial situations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.