Loading

Get Uk Ct600 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK CT600 online

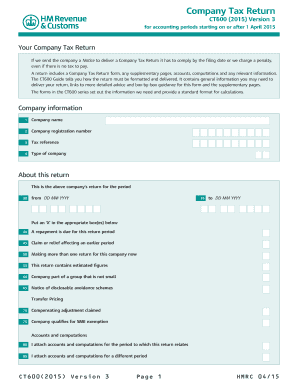

The UK CT600 is a vital document for companies to report their income, expenses, and Corporation Tax liability. Filling it out accurately is essential for compliance with tax regulations and avoiding penalties.

Follow the steps to complete your Company Tax Return electronically

- Click ‘Get Form’ button to access the Company Tax Return form in your preferred digital environment.

- Begin by entering your company’s information: name, registration number, tax reference, and type of company.

- Specify the accounting period for which this return is being made by filling in the dates from and to.

- Indicate if any special circumstances apply by inserting an ‘X’ in the relevant boxes related to repayments, claims for earlier periods, or group status.

- Attach any necessary accounts and computations as applicable, and provide an explanation if they are not attached.

- Complete the tax calculation section, detailing turnover, income, chargeable gains, and any deductions or reliefs.

- Calculate the Corporation Tax due by entering the relevant profit amounts and tax rates.

- Fill out any additional credits, liabilities, and indicators related to payments or repayments.

- Complete the repayment section if applicable, providing bank details for the repayment process.

- Make sure to provide a declaration, ensuring the information provided is accurate, including your name, date, and status.

- Review your entries for accuracy, then save changes, and you can choose to download, print, or share the form as needed.

Complete your Company Tax Return online today for efficient submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Tourists can indeed claim tax back in the UK on eligible purchases made during their stay. The process typically involves using a VAT refund scheme, where you can receive refunds on goods purchased from participating retailers. Just keep all your receipts and ensure you fill out the necessary paperwork before leaving the country. Services like uSlegalforms can help you understand the process and maximize your refund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.