Loading

Get Uk Bor286 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK BOR286 online

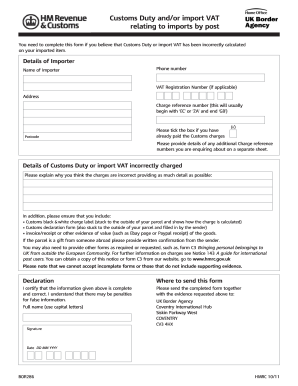

The UK BOR286 form is essential for individuals who believe that Customs Duty or import VAT has been incorrectly calculated on their imported items. This guide will provide you with clear step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to successfully complete the UK BOR286 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the details of the importer section, which includes the name of the importer, address, phone number, VAT registration number (if applicable), and the charge reference number. Ensure this information is accurate and complete.

- Indicate whether you have already paid the Customs charges by ticking the corresponding box provided in the form.

- In the section for details of Customs Duty or import VAT incorrectly charged, provide a detailed explanation of why you believe the charges are incorrect. Include any relevant information that can support your claim.

- Ensure that you attach the necessary supporting documents, including: the Customs black & white charge label, the Customs declaration form, and an invoice or receipt that shows the value of the goods.

- If the item was a gift, include written confirmation from the sender. Check if there are any additional forms required, such as form C3, and provide them if necessary.

- Review the entire form for completeness, as incomplete forms will not be accepted. Ensure that you have signed and dated the declaration section certifying that the information is complete and correct.

- Send the completed form along with all supporting evidence to the UK Border Agency at the specified address: Coventry International Hub, Siskin Parkway West, Coventry, CV3 4HX.

Complete your documents online today to ensure accurate processing of your customs charges.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Submitting your UK tax return from overseas is a straightforward process. You can complete the return online through HMRC's portal. When filling out your tax return, remember to include any income relevant to your UK BOR286 status. This method allows you to file efficiently, even if you are living outside the UK, making sure you meet your tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.