Loading

Get W5 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

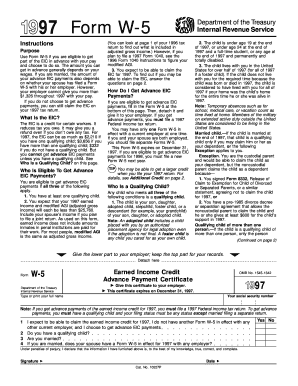

How to fill out the W5 Form online

Filling out the W5 Form online can seem daunting, but with clear guidance, you can complete it efficiently. This step-by-step guide will help you understand the form's components and how to successfully submit it to qualify for advance earned income credit payments.

Follow the steps to complete the W5 Form online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your full name in the designated field. Make sure to type it as it appears in your identification documents.

- Provide your Social Security number in the appropriate box. This is essential for identification purposes and must be accurate.

- Indicate whether you expect to claim the earned income credit for the relevant tax period by checking ‘Yes’ or ‘No’ based on your eligibility.

- Answer the question about having a qualifying child. If applicable, check ‘Yes’; otherwise, check ‘No.’ This section is crucial for determining your eligibility.

- If you are married, indicate whether your spouse has filed a W5 Form with their employer by selecting ‘Yes’ or ‘No.’ This will impact the advancement of payments.

- Under penalties of perjury, declare that the provided information is accurate. Ensure you read this section carefully before proceeding.

- Sign and date the form. This step confirms that you are aware of the implications of the information you provided.

- Save your changes, and once completed, you can choose to download, print, or share the form with your employer.

Complete the W5 Form online today to ensure you get the benefits you deserve.

Those filing for tax year 2018 used (and still should use) Schedule 5 for Other Payments and Refundable Credits. You should attach this form to Form 1040 when filing for tax year 2018 and include any applicable credits in these areas: Estimated tax payments for 2018. Net premium tax credit (attach Form 8962)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.