Get Nj Cri-400 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CRI-400 online

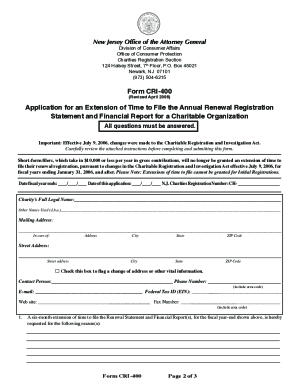

This guide provides a comprehensive overview for users on how to complete the NJ CRI-400 form online, which is essential for charitable organizations seeking an extension of time to file their annual renewal registration statement and financial report. Follow the step-by-step instructions to ensure a smooth and accurate submission.

Follow the steps to successfully complete the NJ CRI-400 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the fiscal year-end date and the date of the application in the respective fields. Ensure these dates are accurate to reflect your organization’s reporting period.

- Provide the New Jersey Charities Registration Number in the designated area. This is crucial for identifying your organization within the Charities Registration Section.

- Fill in the charity’s full legal name and any other names it operates under (d.b.a.). Accuracy is important to avoid any delays in processing.

- Complete the mailing and street address sections. If there are any changes in address or other important details, check the box provided.

- Designate a contact person for your organization and input their phone number, email address, federal tax ID (EIN), website, and fax number.

- Provide a detailed explanation for requesting a six-month extension of time to file the renewal statement and financial report. Be as specific as possible.

- Answer the questions regarding prior renewal registration statements and fees truthfully. If any prior year’s filings are missing or delinquent, the request will be denied.

- Review the final checklist. Confirm that you have met all requirements, including reading the instructions and that all questions are answered accurately.

- Sign the application. This must be completed by at least one officer of the charity along with their title and date of signing.

- Once completed, make sure to save any changes made, and consider downloading or printing a copy of the completed form for your records.

Complete your forms efficiently online today to ensure your charitable organization remains in compliance.

Starting a nonprofit in New Jersey involves several steps, including developing a mission statement, appointing a board of directors, and preparing your bylaws. Once these elements are in place, you must file for incorporation and apply for 501(c)(3) status. Remember, keeping up with annual requirements like the NJ CRI-400 is essential for maintaining your nonprofit's good standing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.