Loading

Get Or Uc 1 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR UC 1 online

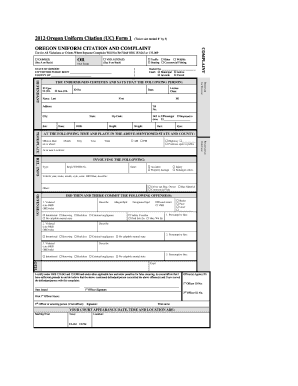

The OR UC 1 form is essential for documenting various violations or crimes in Oregon. Whether you are a law enforcement officer or an individual filing a complaint, understanding how to accurately complete this form is crucial for ensuring proper legal procedures are followed.

Follow the steps to effectively fill out the OR UC 1 online.

- Click the ‘Get Form’ button to obtain the OR UC 1 form and open it in the editor.

- In the ‘STATE OF OREGON’ section, enter the city or public body and county where the citation is issued.

- Select the type of violation by checking either ‘CRIME(S)’ or ‘VIOLATION(S)’; only one may be selected.

- Fill out the docket number and court type, choosing from ‘Municipal’, ‘Justice’, ‘Juvenile’, or ‘Circuit’.

- In the ‘DEFENDANT’ section, input the defendant's last name, first name, middle initial, address, phone number, and date of birth.

- Enter physical characteristics such as height, weight, hair color, and eye color.

- Provide the offense date and location details including specific time and whether it's at a highway or public premises.

- In the ‘OFFENSE(S)’ section, list each offense citing the relevant ORS/ORD/rule and include a description of the violation.

- Indicate the mental state associated with each offense, selecting from options like ‘Intentional’, ‘Knowing’, ‘Reckless’, or ‘No culpable mental state’.

- Complete any additional remarks or explanations as necessary, ensuring you sign and date the form.

- Once finished, save your changes, and you can download, print, or share the completed form.

Complete your filing of the OR UC 1 form online today to ensure compliance with legal requirements.

On a W-2, UC typically denotes Unemployment Compensation, highlighting that part of your income for the year may have come from unemployment benefits. This information is crucial for accurate tax reporting, as unemployment benefits are taxable. Reviewing any UC notations on your W-2 helps ensure compliance and avoids potential complications with tax authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.