Loading

Get Preauthorized Chequing (pac) Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Preauthorized Chequing (PAC) Authorization online

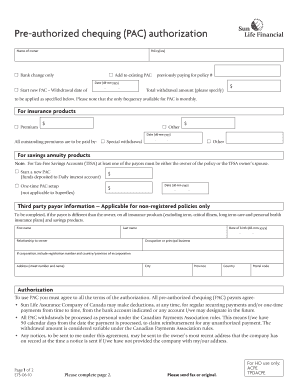

The Preauthorized Chequing (PAC) Authorization form allows users to set up automated withdrawals for insurance and savings products. This guide provides a clear and supportive walkthrough to ensure a smooth filling process of the form online.

Follow the steps to complete your PAC Authorization efficiently.

- Press the ‘Get Form’ button to download and open the PAC Authorization form in your preferred document editor.

- Begin by entering the name of the owner of the policy in the designated field at the top of the form. Ensure that you provide the full legal name.

- In the 'Policy(ies)' section, specify if you are making a change to an existing PAC or starting a new PAC. Select the appropriate option by marking the box beside 'm Bank change only,' 'm Add to existing PAC,' or 'm Start new PAC' as necessary.

- If starting a new PAC, indicate the desired withdrawal date by filling in the 'Withdrawal date' fields using the format dd-mm-yyyy.

- Specify the total withdrawal amount intended for recurring payments. Ensure to note this amount in the specified dollar field.

- For insurance products, indicate whether the amount is a premium or another type by selecting the appropriate box and inputting the amount in the corresponding field.

- If applicable, enter any outstanding premiums or special withdrawals by selecting the appropriate options.

- For savings products, provide details in the respective section, including starting a new PAC and any one-time PAC setup. Input the relevant amounts and dates as necessary.

- If the payor differs from the owner, fill in the 'Third party payor information' section with the first name, last name, relationship to the owner, date of birth, occupation, and address details.

- Review the Authorization section carefully. Confirm your agreement with the terms stated by checking the acknowledgment boxes.

- Sign and date the form in the areas designated for the signature of the bank accountholder, and include your address.

- Lastly, attach a voided cheque to the form to provide the necessary banking information and ensure accuracy.

- Once you have completed all sections of the form, save the document, and proceed to download, print, or share it as needed.

Complete your Preauthorized Chequing (PAC) Authorization online today for hassle-free payment management.

They also appeal to people who want to automate their financial lives, so they don't have to pay each bill manually. Pre-authorized debit is a very secure form of payment because financial institutions encrypt the information just as they do when you send an e-transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.