Loading

Get Ny Ls-223 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY LS-223 online

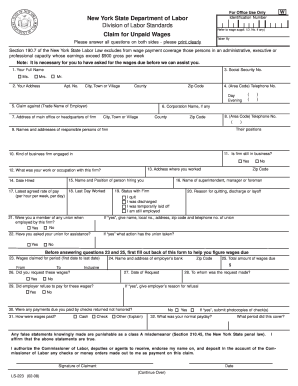

The NY LS-223 form is essential for individuals seeking to claim unpaid wages in New York. This guide provides clear, step-by-step instructions to help users complete the form effectively, ensuring all necessary information is accurately captured.

Follow the steps to successfully complete the NY LS-223 form online.

- Click the ‘Get Form’ button to access the NY LS-223 form and open it in the online editor.

- Begin filling out the form by entering your full name in the designated field. It is crucial to avoid using abbreviations and to ensure clarity.

- Provide your complete address, including the apartment number, city or town, county, and zip code in the specified fields.

- Enter your area code and both day and evening telephone numbers to facilitate communication.

- Identify the trade name of your employer in the corresponding section, ensuring accuracy to prevent any delays.

- If applicable, fill in the corporation name of your employer.

- Input the address of the employer's main office or headquarters, including city, town, county, and zip code.

- Provide the area code and telephone number for the employer's office in the next field.

- List the names and addresses of responsible persons at the firm to assist in processing your claim.

- Indicate whether the firm is still in business, selecting 'Yes' or 'No' as appropriate.

- Specify the kind of business the employer engages in, providing enough detail to clarify your employment context.

- Input your work address where you performed your duties with the firm.

- Detail your occupation with the employer, clearly stating the position you held.

- Indicate when you were hired by entering the date in the format requested.

- Provide the name and position of the individual who hired you.

- Document your last day worked at the firm as part of your employment history.

- State your latest agreed rate of pay and specify if it was per hour, per week, or per day.

- Clarify your status with the firm from the options provided, indicating whether you quit, were discharged, were temporarily laid off, or are still employed.

- If you were part of a union while employed, indicate 'Yes.' If so, provide the name, local number, address, zip code, and telephone number of the union.

- If applicable, indicate whether you have sought assistance from your union and what actions have been taken.

- After reviewing the prior sections, fill out the back of the form to determine the exact wages due.

- Provide the period for which you are claiming wages, indicating the start and end dates.

- State the total amount of wages you claim, ensuring accurate reporting.

- Specify whether you requested these wages from your employer, indicating the date and to whom the request was made.

- Indicate if the employer refused to pay these wages, and if applicable, provide their reason for refusal.

- If you received payment by checks that were not honored, mention this, and enter any check numbers that apply.

- Explain how your wages were typically paid (cash, check, other) and indicate your normal payday.

- Submit the completed form, ensuring that all fields are filled out accurately. Save your changes, and download or print the form as needed.

Complete your NY LS-223 form online today for a smooth claims process.

Yes, you can sue your employer for not paying you on time in New York. Under the NY LS-223 guidelines, an employee has the right to seek legal action if their employer fails to meet payment deadlines. It is important to gather evidence of the missed payments and consult with a legal professional to navigate this process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.