Loading

Get Ga Dor Att-104 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR ATT-104 online

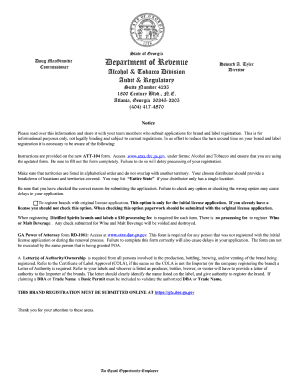

Filling out the GA DoR ATT-104 form for brand and label registration is an essential step for compliance in the alcohol and tobacco industry. This guide provides clear instructions for each section of the form, ensuring users can complete it accurately and efficiently.

Follow the steps to successfully complete the GA DoR ATT-104 form

- Click the ‘Get Form’ button to obtain the GA DoR ATT-104 form and open it in the editor.

- Begin by entering the name of the person submitting the application in the 'Submitted By' section. Ensure all required fields are filled out accurately.

- In the 'Submitted To' section, confirm that you are submitting the form online to the Georgia Department of Revenue.

- Review the initial instructions. All applications must be typed or printed. Make sure to include one label and a copy of the Federal Label Approval for each label being registered.

- Check the 'Reason for Submitting This Application' section and select the appropriate option. Note that failure to select an option may delay processing.

- Complete the sections for the brand/brand label names. List multiple brands in alphabetical order, if applicable.

- Fill in the designated wholesaler information, if applicable, including their address and Georgia distributor license number.

- If you are not the producer of the brand, ensure that you attach a Letter of Authority from the producer granting you exclusive rights to distribute the brands.

- Sign the application in the designated section, ensuring the signature is legible. If not signed by an owner or officer of the company, attach the GA Power of Attorney form RD-1061.

- Once all fields are complete and reviewed, you can save changes, download, print, or share the form as necessary.

Complete your GA DoR ATT-104 form online today to ensure timely processing of your brand and label registration.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

No, a sales tax ID and an Employer Identification Number (EIN) are not the same in Georgia. The sales tax ID allows you to collect sales tax, while the EIN is used for federal tax purposes. Both are essential, but they serve different roles in your business operations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.