Loading

Get Uk Hmrc Ca3916 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC CA3916 online

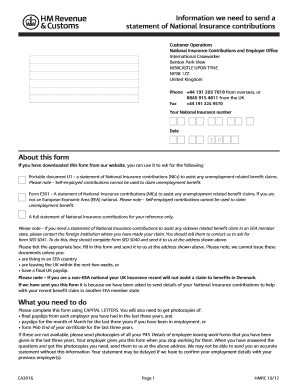

The UK HMRC CA3916 form is essential for individuals seeking a statement of National Insurance contributions. This guide will provide step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to access the CA3916 form and open it in your document editor.

- Begin with ‘About you.’ Provide your title, surname, first names, and any other surnames used. Enter your National Insurance number and date of birth, and confirm your gender. Also, indicate your nationality and phone number for communication.

- In ‘Where you live,’ specify your country of residence after leaving the UK, along with the address in that country and employer’s tax district and PAYE reference number, found on your payslip or employment documents.

- For ‘Your last UK employer,’ fill in your last employer’s name and address, the relevant Jobcentre Plus phone number, and whether you are applying for a statement to claim unemployment benefits abroad. If yes, provide the start date of your Jobseeker’s Allowance claim.

- Next is ‘Your UK employers.’ Include details of any UK employment in the last three years, specifically employer names, addresses, job titles, start and end dates of employment, and payment frequency. Provide details of average pay and working hours.

- Indicate if you have been self-employed in the UK, and if so, mark the relevant dates of employment. If applicable, include the Jobcentre Plus office details for Jobseeker’s Allowance claims.

- If you do not have a UK National Insurance number, provide employment details in the required format for your employed periods, including staff reference numbers and payroll details.

- Use the ‘More information’ section if you need to expand on any questions, or attach a separate sheet outlining your responses.

- Complete the declaration section by signing and dating the form, confirming that all information provided is accurate.

- Finally, utilize the checklist to ensure you have included required photocopies of your payslips and P60 forms and send them to the listed address.

Complete your UK HMRC CA3916 form online now to ensure your application is processed efficiently.

National Insurance contributions in the UK depend on your earnings and employment status. You can calculate your contributions using the guidance found in the UK HMRC CA3916. For additional support, consider using uslegalforms, which can simplify your understanding and management of these contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.