Loading

Get Canada T2 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 online

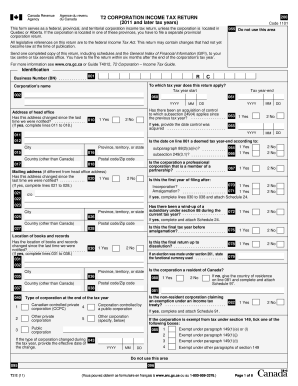

The Canada T2 form is a critical component for corporations in Canada to report their income and calculate their taxes. This guide aims to assist users in completing the Canada T2 form online with clarity and ease.

Follow the steps to fill out the Canada T2 form online.

- Press the ‘Get Form’ button to acquire the form and access it in your digital environment.

- Begin with the identification section, providing the business number, the corporation's name, and the tax year start and end dates. Ensure the dates are in YYYY/MM/DD format.

- In the address section, input the head office address. If there has been a change, state 'Yes' and fill in the required fields.

- Continue with questions about acquisition of control, final returns, and other corporate statuses. Answer honestly as each response may impact your return.

- Complete the information about the type of corporation by selecting from the options provided, indicating if it is a Canadian-controlled private corporation or another type.

- If applicable, answer questions regarding related corporations, associated CCPC, and transactions with non-residents. If any apply, ensure to attach the required schedules.

- Proceed to fill out the financial statement information using the General Index of Financial Information (GIFI). Attach Schedules 100, 125, and 141 as necessary.

- Double-check all sections for accuracy, ensuring that there are no errors in amounts or dates.

- Once you have completed the form, you can save the changes, download a copy for your records, print the form, or share it with relevant parties.

Start preparing your Canada T2 form online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To enter Canada, US citizens typically need to complete the Canada Customs Declaration form. This form collects information regarding your travel intentions and goods. Ensure you have this form ready to expedite your entry process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.