Get Aessuccess

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aessuccess online

Filling out the Aessuccess form is a straightforward process designed to help users apply for teacher loan forgiveness. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete your application.

- Press the ‘Get Form’ button to access the Aessuccess form and open it in your preferred editor.

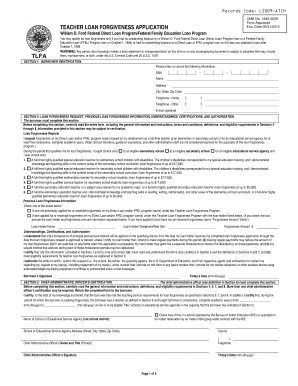

- In Section 1, fill in your borrower identification details. Be sure to provide your Social Security Number, name, address, city, state, and zip code. Include your home and other telephone numbers, and optionally, your email address.

- Proceed to Section 2 where you request loan forgiveness by selecting the appropriate employment status as a full-time teacher. Indicate the type of school or educational service agency and select your qualifying employment status. This section requires careful consideration as it directly affects your eligibility for forgiveness.

- If applicable, provide previous loan forgiveness information. Indicate whether you have previously applied for or received forgiveness, and if so, include the loan holder's name and the forgiveness amount.

- Read through the Understandings, Certifications, and Authorization section. You need to confirm that the information you have provided is accurate and that you understand the terms regarding your loan forgiveness request.

- In Section 3, obtain the required certification from the chief administrative officer at your educational institution. This person will verify your qualifying teaching service.

- Return to Section 4 for important general information and instructions. Make sure you follow the guidelines on how to fill out the form properly, including formatting dates correctly.

- Once completed, review all entered information for accuracy. You may now save the changes, download the completed form, print it, or share it as necessary.

Start your application today and take an important step towards obtaining loan forgiveness!

To successfully complete the American Opportunity credit on your tax return, start by gathering your tax documents, including Form 1098-T from your educational institution. Next, use this form to fill out IRS Form 8863, where you will provide information about your qualified education expenses. When you understand how to fill out this form correctly, you increase your chances for a significant tax benefit that can bolster your financial situation. With tools like Aessuccess, you can simplify the process and ensure all necessary information is submitted accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.