Get Close Business Account/cancel Ein

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Close Business Account/Cancel EIN online

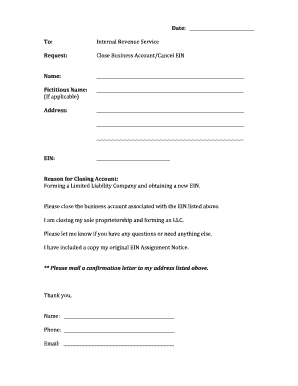

Closing a business account and canceling an Employer Identification Number (EIN) can be a straightforward process when you have the right guidance. This guide will help you fill out the Close Business Account/Cancel EIN form efficiently online, ensuring all necessary details are completed accurately.

Follow the steps to complete your form successfully.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering the current date at the top of the form. This should reflect when you are submitting your request.

- In the 'To' section, specify that the request is directed to the Internal Revenue Service (IRS).

- Next, accurately fill in your name in the designated 'Name' field to identify the person or entity submitting the request.

- If applicable, provide your fictitious business name, which is also known as a 'doing business as' (DBA) name.

- Fill out your complete business address in the 'Address' section, ensuring it matches the address on file with the IRS.

- Enter your EIN in the respective field. This number is crucial as it identifies your business with the IRS.

- Indicate your reason for closing the account. You may mention forming a new legal entity, such as a Limited Liability Company (LLC), or specify if you are ceasing operations.

- Include any relevant information you feel necessary to the IRS, such as your request for closure and any documents, like the EIN Assignment Notice, that support your request.

- Finish by signing your name, adding your phone number and email address in the respective fields. This information allows the IRS to contact you if needed.

- After filling out the form, review all entries for accuracy. Save your changes, and proceed to download, print, or share the completed form through your preferred method.

Begin closing your business account and canceling your EIN online today!

To find an EIN for a closed business, you can check previous tax documents or bank statements that include your EIN. If you don't have these documents, contact the IRS directly for assistance. Remember, having access to this information is crucial for handling any tax matters post-closure. If you need expert guidance, platforms like UsLegalForms can help you locate your EIN efficiently.

Fill Close Business Account/Cancel EIN

If you no longer need your employer identification number (EIN), we can't cancel it, but we can deactivate it. To cancel your EIN and close your IRS business account, you need to send us a letter that includes: The complete legal name of the business. The IRS cannot cancel your EIN. The IRS cannot cancel EIN numbers; however, the business account associated with the EIN may be closed. The IRS will not cancel a EIN. Please close the business account associated with the EIN listed above. I am no longer using this account. You have to inform the IRS of the account closure linked with the EIN for the business willingly dissolved. To close your EIN account, notify the IRS in writing that you wish to close the business account associated with the EIN. The IRS can close your business account if you determine that you no longer need your EIN.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.